Falling GDP, rising unemployment, an economic crash: not everyone agrees these things are to be avoided

Late last year the Bank of England described a worst case scenario that could follow a disorderly Brexit. It warned of an immediate economic crash, sinking GDP and rising unemployment.

Many Remainers seized on the modelling to convince Leavers the error of their ways. As at the referendum, the Remain case continues to be primarily economic, citing the financial penalties of leaving.

Such an approach is predicated on the fact that Leave voters understand these economic changes to be “bad things” in the same way that Remain voters do. But is that actually the case?

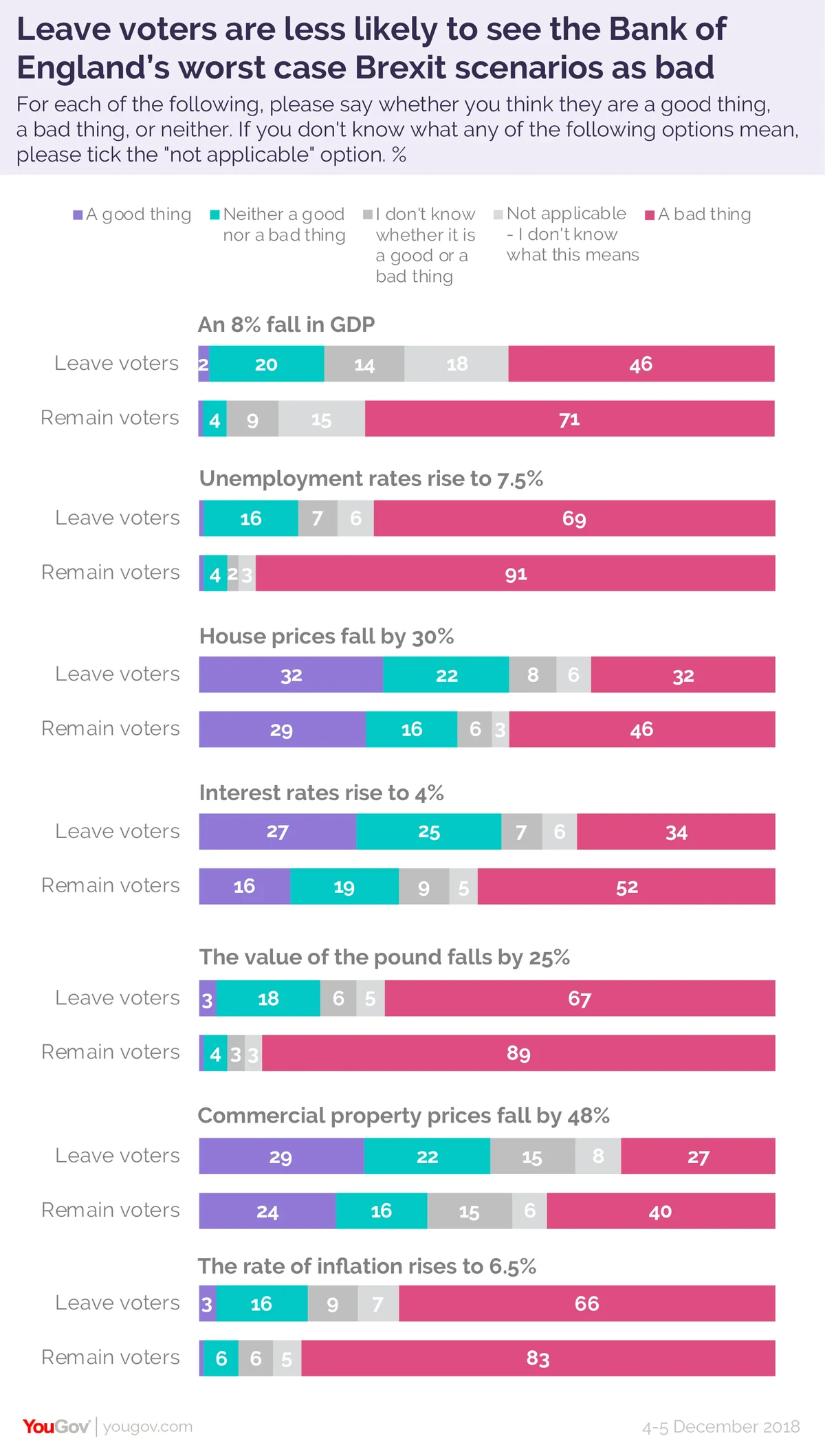

New YouGov research shows that Leave voters are far less likely to be worried about the scenario set out by the Bank of England than Remain voters.

For instance, 77% of Britons believe that the Bank’s projected rise in unemployment to 7.5% would be a bad thing. Among Leave voters this figure falls to 69%, whereas 91% of Remain voters see it as negative.

While only 1% on either side consider a GDP drop to be a good thing, 16% of Leave voters say that it’s neither a good thing nor a bad thing, compared to just 4% of Remainers.

Leave voters are also more likely to see an interest rate rise to 4% as a good thing (27%, compared to 16% of Remain voters). Leave voters tended to be older, so an increase in interest rates would benefit savings and pensions.

A price worth paying?

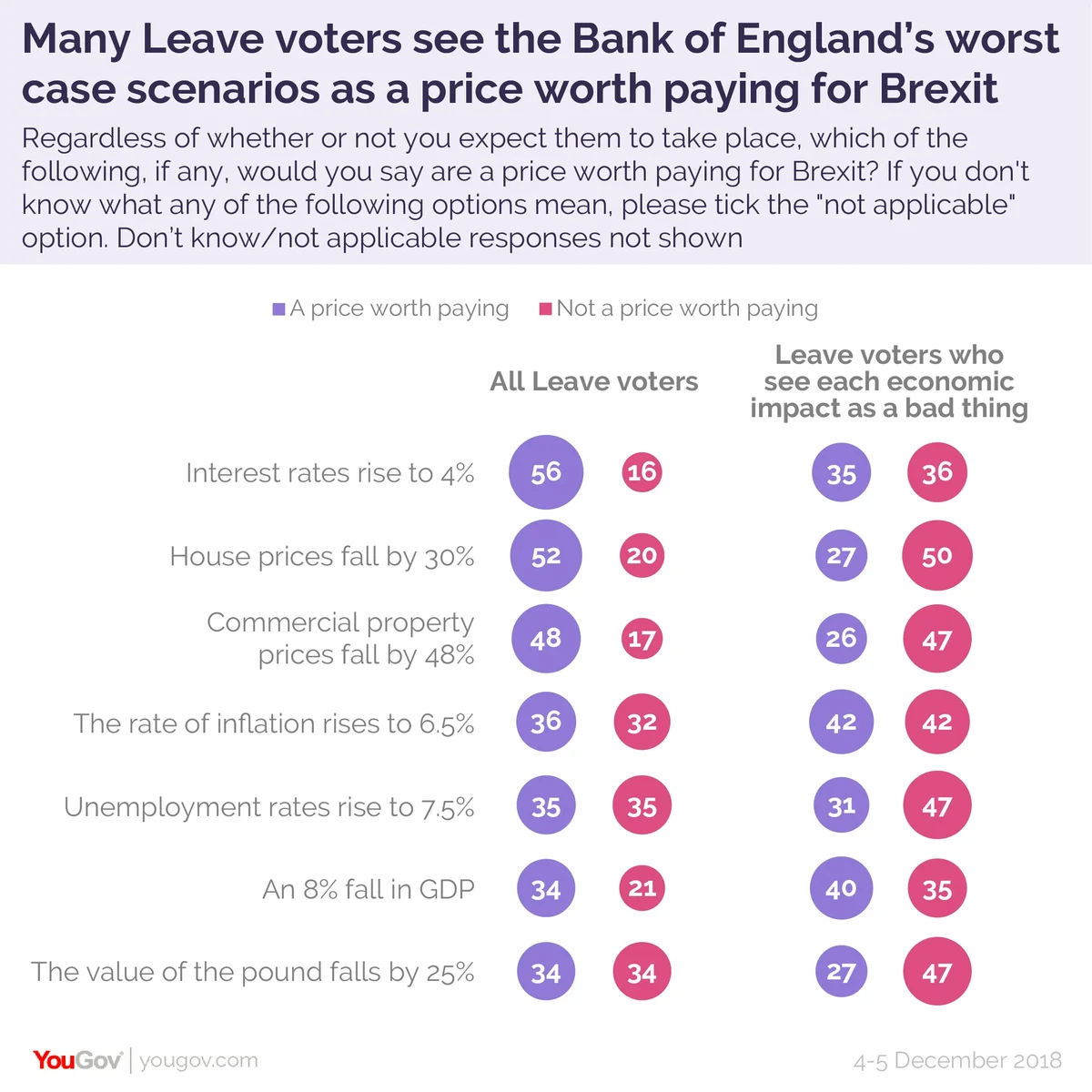

A second question asking whether each of the scenario’s impacts would, individually, be a price worth paying for Brexit saw Leave voters more likely to say yes.

The majority of Leave voters (56%) see interest rates rising to 4% as a price worth paying for Brexit, compared to only 16% who don’t. Likewise, they are substantially more likely to see falling house prices and commercial property prices as a price worth paying for Brexit than not (52% vs 20% for the former, 48% vs 17% for the latter).

Leave voters are, however, evenly split on the prospect of unemployment rising (35% think it would be a price worth paying while 35% did not) and the value of the pound falling by a quarter (34% vs 34%) and inflation rising (36% vs 32%).

Even among those Leave voters who see each of the potential impacts as a bad thing, notable minorities (26% to 40%) still consider them to be a price worth paying – although, with the exception of the GDP drop, they are outnumbered by those who think they are not.

It must be noted, however, that it’s unlikely many Leave voters expect the Bank’s worst case scenario to come to pass. In fact, a YouGov study in November found that 57% of Leave voters don’t expect a single negative consequence of Britain pulling out of the EU. Those Remain voters who still believe in the power of Project Fear are likely to find that their faith as misplaced now as it was at the referendum.

Photo: Getty