Last week, we conducted two online discussion groups to explore the Brexit-related views of senior decision-makers in small businesses (with 1-50 employees) and medium sized organisations (250-999 employees)

Participants were chosen from a spread of different industries, sectors, and views of Brexit – both in terms of how they voted and how they think the result has affected their business.

Small businesses (1-50 staff)

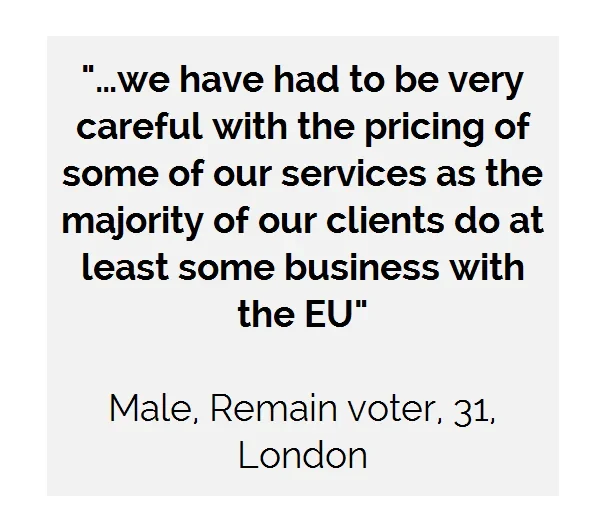

It was clear that small businesses had, to varying extents, been affected by the result of the vote. Participants felt that the outcome of the referendum had created uncertainty and that this uncertainty had led to a slow-down in custom.

Perhaps as a result of this, there was a strong desire to set the wheels of Brexit in motion, even among those who voted Remain. They felt that Article 50 should be triggered as soon as possible, as they thought that providing some certainty about timescales might help the markets to recover.

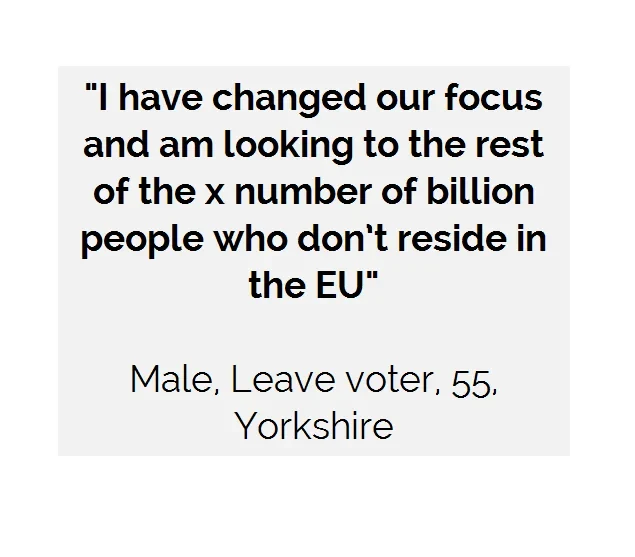

This sense of uncertainty also seems to have resulted in many of them exploring other avenues in order to keep their businesses successful. For example, those who feel business closer to home has dried up are reaching out to markets further afield, in anticipation of Brexit impacting trade with the EU.

For others there is a sense that a ‘staggered’ approach to Brexit may provide an opportunity to plan strategically for the future. When we asked participants if they had foregone marketing or publicity activities since June, many said the opposite was true and that they were actually ramping-up this activity – speculating to accumulate in an uncertain business landscape.

With this in mind, when the group talked about the next two years, they painted a more optimistic picture for their business. For some – particularly Leave voters – the most difficult period of readjustment was already out of the way. Once they know what Brexit will look like and when it will happen, they look forward to the future.

But despite this mild optimism, no one believed that small businesses are Brexit-proof. Being able to adapt was paramount, both in terms of what they offer to customers and what new markets offer to them.

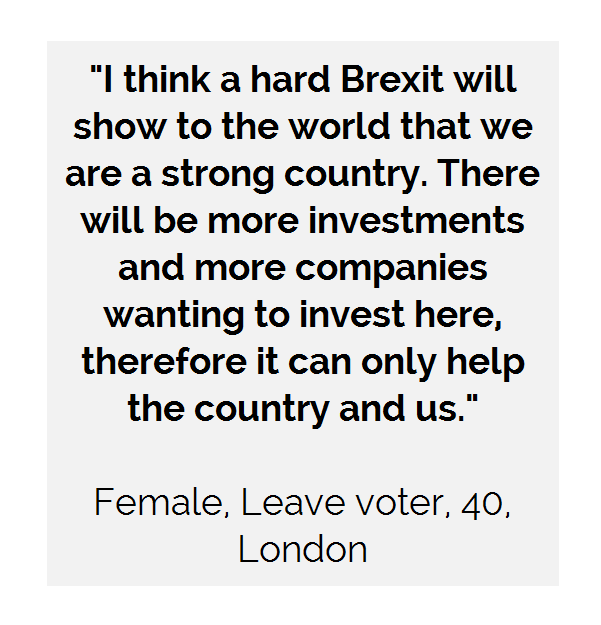

In discussing the ideal form of Brexit there was a lack of consensus and opinion was, curiously, not necessarily split by voting behaviour. Some Leave voters talked about a personal preference for a ‘hard’ Brexit – with no access to the single market and being out of the customs union. However, they conceded that a ‘softer’ Brexit, with access to the single market, may be beneficial for their business.

Medium-sized businesses (250-999 staff)

Amongst senior decision-makers in medium sized businesses, there was also a desire to get on with Brexit. There was a feeling – even amongst those who voted Remain – that the uncertainty around Brexit was destructive and that clarity around timings and arrangements for leaving the EU would temper some of this.

There was limited appetite for a fresh general election, delaying invoking Article 50, or anything that might have an impact on the UK’s inevitable departure from the EU. However, there was measured support for parliamentary involvement when it comes to the terms of the negotiation.

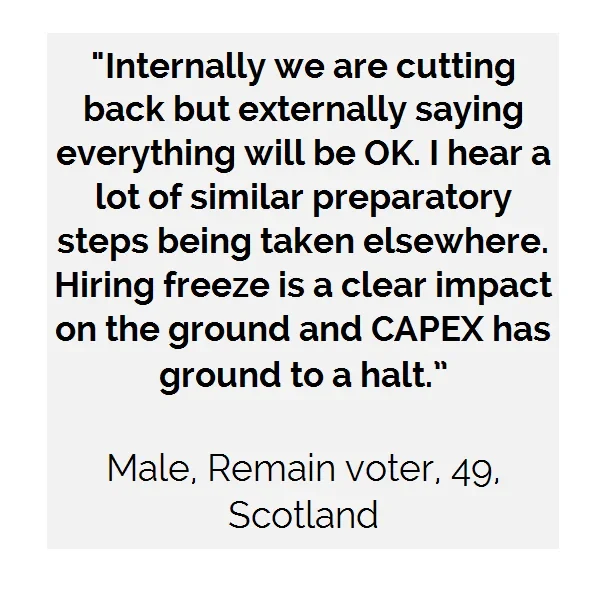

The decision-makers had a sense that companies of this size are more resilient than smaller companies, and better able to absorb any impact on orders or revenue. Many admitted that they have postponed decisions on investments and pay and bonuses until either next year or even further into the future – when they hoped there would be more certainty around Britain’s trading status and our relationship with Europe.

While medium sized businesses share anxiety about the sense of uncertainty, where they differed from decision makers in small business is that many felt that a Brexit ‘crunch’ had not yet hit their organisations. This group believed it may not be until next year that it does so and that the two years before Brexit (2017-19) were likely to be more economically perilous than the six months since the referendum vote.

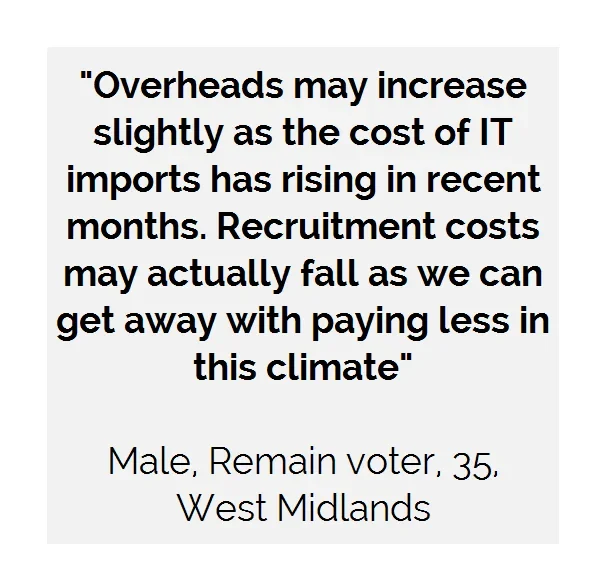

Decision-makers in medium-sized businesses did not feel that their organisations had sufficiently recovered yet from the last economic downturn. Many reported a long-term hangover from the recession, implementing pay freezes and still acting cautiously, particularly when it comes to recruitment.

For some, streamlining resources to help maximise their staff’s potential was preferred to hiring new staff. But there was equally an indication that Brexit is providing medium-sized companies with an excuse to be less competitive with pay.

As with small business owners, there was no consensus over the preferred type of Brexit. Some Remain voters advocated a ‘hard’ Brexit as they believed “playing hardball” would make the UK look resolute as we sit at the negotiation table.

The future

Overall, both groups could be characterised as expressing uncertainty with a tinge of cautious optimism. Irrespective of how they voted, there was a desire throughout the decision-makers we spoke to in small and medium-sized businesses to seek the best deal for Britain. This also helped them to see Brexit through a more optimistic lens – viewing it as a chance to renegotiate trading terms and re-aligning our standing as a nation, despite the short-term difficulties that first may have to be endured.

Further research

We will aim to further examine and explore the effect Brexit has on the public - both as voters and consumers - in the months ahead. Areas we will look at include household finances, financial products and the retail and purchasing landscapes, and clients are welcome to ‘buy in’ to specific discussion areas

More information about YouGov's Qualitative research

Image from PA