While RBS says the time is nigh for selling the taxpayer's stake, the public isn’t so sure.

Royal Bank of Scotland (RSB) remade the headlines recently when it announced a return to profit – £826m in the first quarter of this year compared with a £1.4bn loss at the same point in 2012 – and that it could be ready to sell off part of the UK Government’s 81% stake in the bank by as early as next year.

RBS Chief Executive Simon Hester said privatisation of the bank “would be a terrific thing for the country”, but according to a recent survey produced for the latest YouGov-Cambridge Conference, the British public isn’t so sure.

As part of extensive research for our April Symposium on “Public Trust in Banking”, respondents were shown several scenarios for the future of the bailed-out bank.

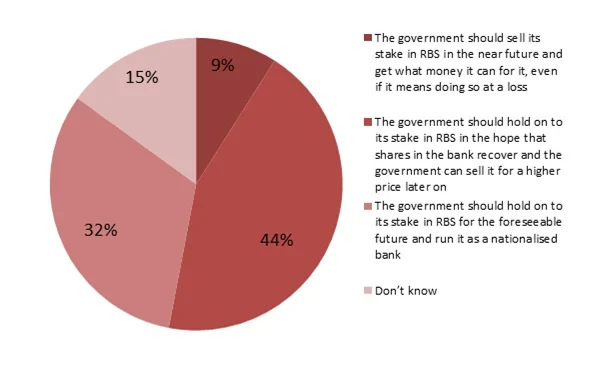

A substantial 76% opposed the early move to sell the government’s stake, including:

- a 44% plurality saying “the government should hold on to its stake in RBS in the hope that shares in the bank recover and the government can sell it for a higher price later on”.

- a substantial 32% minority saying “the government should hold on to its stake in RBS for the foreseeable future and run it as a nationalised bank”.

Only 9% – less than one in ten – said “the government should sell its stake in RBS in the near future and get what money it can for it, even if it means doing so at a loss”.

Which of the following comes closest to your view?

Fieldwork for the question on RBS ownership was conducted online between 11-12 April, 2013, and total sample size was 1,982 British Adults. The data has been weighted and the results are representative of all British adults aged 18 or over.

Some parts of the government might be angling for a good-news story about freeing up taxpayers’ money for other needs. But as the recent YouGov report on banking helped to illustrate, some five years after the initial banking crisis, the reputation of the sector remains terrible as a whole, and public opinion still seems a long way from trusting big banks to act in the broader national interest.

73% of Britons describe the reputation of banking as bad in a list of 26 industries, giving it a joint-worst rating on the same level as betting shops, casinos and online gambling. Voters are in little doubt about its continued centrality to modern life – ranking it joint second alongside retail and after construction in a list of the most important sectors to the economy. But only 21% agree that “UK banks are now learning from their mistakes and behaviour is improving”, versus 45% who disagree. A crushing 80% majority still think banks aren’t “doing enough to get us out of this economic crisis”.

Meanwhile RBS might be recovering its balance sheet, but its overall reputation is yet to catch up.

As YouGov’s Oliver Rowe explains in the YouGov banking report: among attitudes to seven banking groups, the Co-operative Bank and Nationwide enjoy the best reputations, with 42% saying their reputations are good and around 9% saying bad (net positive for The Co-op is +34%, Nationwide +32%).

By comparison, RBS is still at the bottom of the list with 51% scoring it negatively and just 11% positive (net -40%). Barclays has a net negative of -22% while Lloyds Banking Group is net negative -20%.

In other words, the ways of RBS and other banks may be changing significantly, but large sections of the public are yet to notice.