Changing handset market: latest research explores key future challenges for smartphone brands

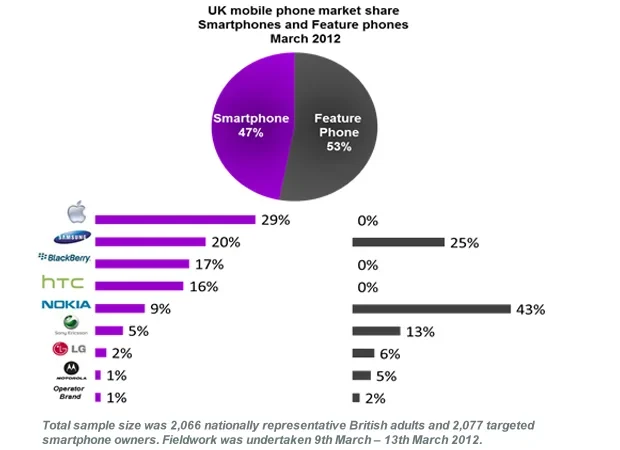

In the UK, there has been a steady but slowing growth of smartphone usage; latest research from YouGov’s Technology and Telecoms team confirms that almost half of mobile owners now use smartphones (47%).

- Apple’s iPhone leads the way with close to 30% share of the smartphone market

- Blackberry has steadily lost share over the past two years (17%)

- Samsung and HTC have gained popularity, representing clear threats to Apple’s dominance in the market, increasing their shares to 20% and 17% respectively

Despite resistance from feature phone owners, we anticipate that smartphones will dominate the market with a clear majority (over 55%) within the next 12 months. Therefore, the onus is on the feature phone market as they represent key conversion opportunities for manufacturers.

Samsung, in particular, has a firm presence in both smartphone and feature phone markets: 20 and 25% respectively, meaning the manufacturer is in a great position to convert feature phone users with established products in both markets.

Nokia remains the most popular manufacturer for feature phone owners, holding the largest share of the market, with over 40%. Nokia holds a unique opportunity to capture and convert a sizeable proportion of the feature phone market. However, unlike Samsung, Nokia lacks smartphone market share and has famously struggled to capture the current market with their smartphone offerings.

The 'Late Majority' and 'Laggards'

Conversion of the feature phone market will not be easy; the challenge for manufacturers is converting the ‘Late Majority’ and ‘Laggard’ segments who are not necessarily technology-focused and are sceptical of the value of smartphones.

Our latest SMIX (Smartphone Mobile Internet eXperience) findings confirm this: over 40% of feature phone users “have no need for a smartphone”; over 50% are “happy with their regular mobile phone”.

Indeed, scepticism amongst this group translates to less than 40% expecting to switch handsets within the next 18 months and only 42% of that group expecting to switch to smartphones. In other words, roughly 16% of the current feature phone users will switch to smartphones in the next 18 months.

Smartphones too expensive?

Our research indicates that expense appears to be another critical issue with conversion, between 30% and 40% of feature phone users also feel that “smartphone handsets are too expensive”. For their part, manufacturers have sought to address this issue; with the exception of Apple, most smartphone manufacturers have expanded product lines to include less expensive models, in order to appeal to transitioning feature phone users.

And this strategy may be paying off for Samsung and HTC; Apple barely holds its own in the smartphone market, gaining just 30% of the feature phone converters. Samsung and HTC, however, grab 25% and 16% respectively.

All other things being equal, we predict that Samsung and HTC will increase their share of the smartphone market over the next year.

'Too little, too late'

This is not the case for Blackberry and Nokia however, as their diversified product portfolio strategy does not appear to be paying off. Blackberry has suffered from well documented problems both in the UK and worldwide. Nokia, despite currently having the lion’s share of the feature phone market, has been unable to convert this base to its smartphone models (Lumia) and may capture just 4% of feature phone converters within the next 18 months.

“This situation may be a case of Nokia coming to the smartphone party, too little and too late - their loss of share may be permanent”, says John Gilbert, Consulting Director of YouGov’s Technology and Telecoms team.

Gilbert continued, “To address the various barriers to smartphone conversion requires a better understanding of the complacent and currently satisfied feature phone market.

Smartphone features, such as the wide variety of apps, need to be communicated more effectively, as they will play an increasingly crucial role in handset selection in future”.

See the full Press Release and further details

For more information please contact YouGov's press office via email or call +44 (0)2070126015