It’s no wonder that millennials differ from their older counterparts when it comes to banking. Having grown up in the shadow of the 2008 recession, life has always been more uncertain for this generation. And gone are the days of easy credit, with 86% of millennials believing that the idea of being in debt is stressful.

In addition, 70% say they manage their finances well, turning the stereotype of millennials as lazy and entitled on its head.

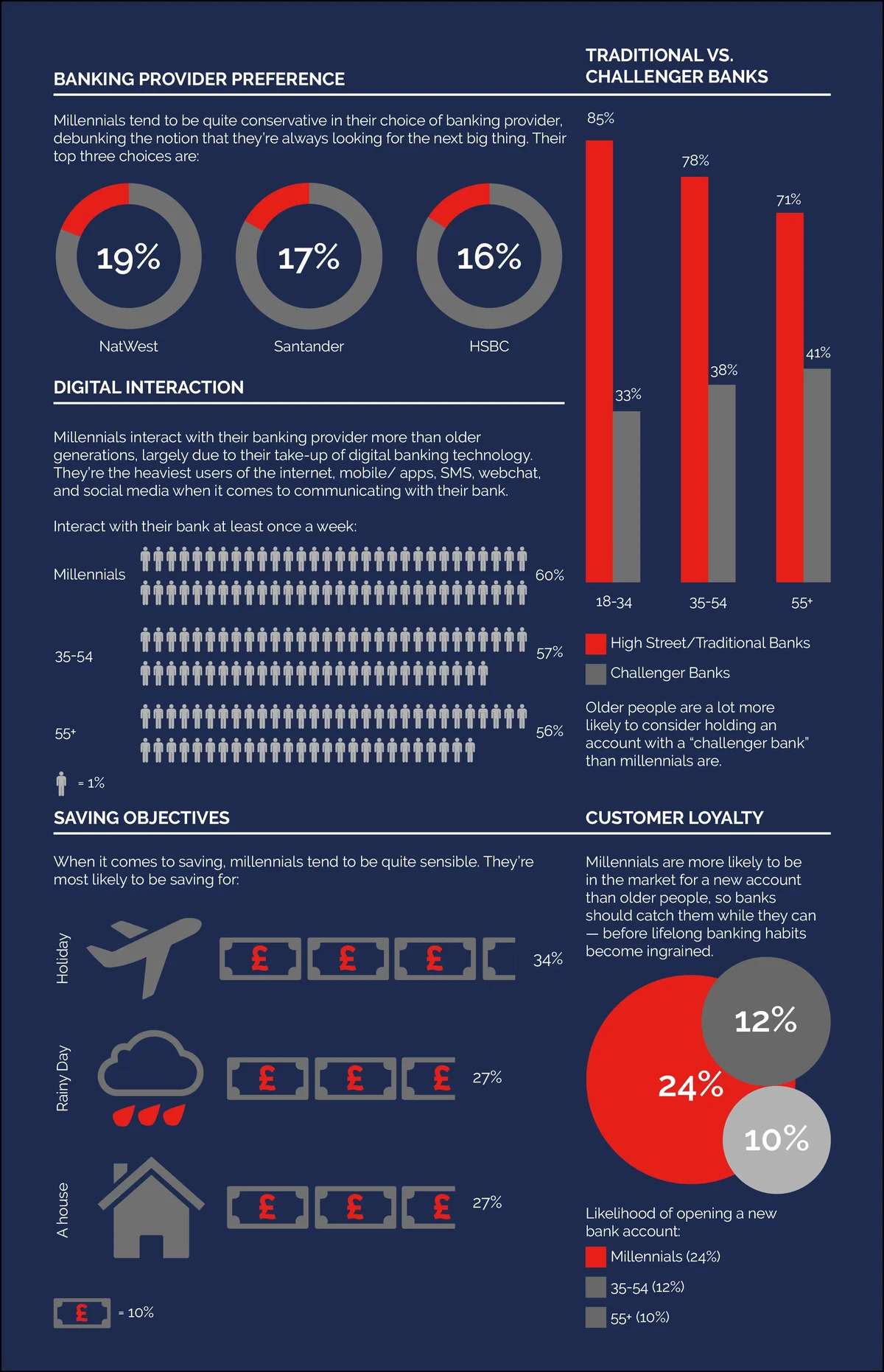

It turns out that millennials are surprisingly practical when it comes to money. Here are five big ways young people are approaching their finances differently:

If you’d like to learn more about millennials, view our webinar: “Are Banks Meeting the Needs of Millennials?” with Jake Palenicek, YouGov’s Director of Financial Services or explore our report “Generation Millennials”. You can also find more information on YouGov’s dedicated financial services experts here.

* Data is taken from research conducted in June 2016, which surveyed 4,000 UK adults. Millennials refer to those aged 18-34 (born in 1982 or later). Additional data is taken from YouGov’s Profiles tool which helps you find out more about the demographics which matter most to your business.