JD Sports and Sports Direct are known rivals and their parent companies own most of Britain’s high streets. While both sell many of the same brands, there are marked differences in the companies’ focuses, with JD Sports selling sports-fashion and Sports Direct selling sports equipment and clothing.

Earlier in January, JD Sports predicted its annual profit would exceed forecasts after robust online trading over the Christmas period of athleisure wear. On the other side is Sports Direct, a business that is heavily reliant on bricks and mortar sale, which had to scrap forecasts of surging profits in December after Tier 4 and lockdowns kept stores closed.

YouGov Profiles data shows clear differences between the competitors’ customer bases. While large proportions of both brand’s customers are aged 40 to 59 (38% of those who’ve purchased from JD Sports in the last 12 months, 41% of Sports Direct customers), young Britons (18 to 24-year-olds) are twice as large a portion of JD Sports’ customer base as Sports (22% versus 11%).

The brands’ customer bases are motivated to shop somewhere by different things too. Sports Direct customers are most likely to say that finding the lowest price is their biggest purchase motivator (19%), while for JD Sports customers a store having the best quality products is the most important reason they choose to shop there (19%).

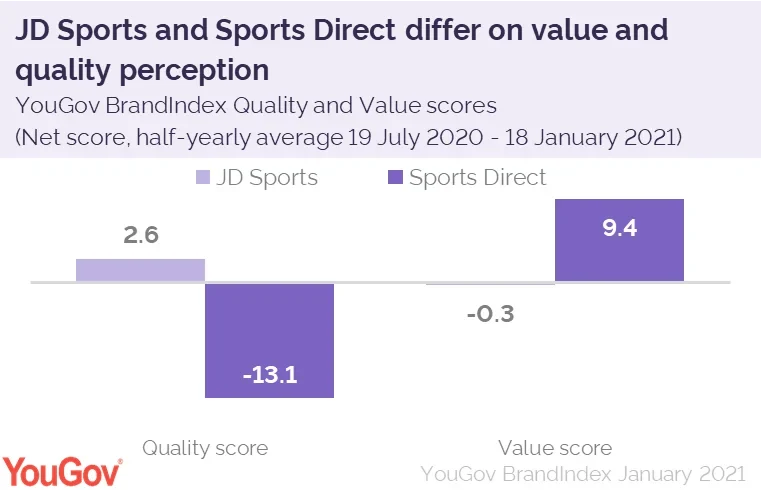

While good value for money and high quality products are important to the brand’s respective customers, YouGov BrandIndex data shows that the brands are also perceived this way by the public. Sports Direct’s Value score (a net measure of whether consumers think the brand represents good or poor value for money) is 9.7 points higher than its rival at 9.4 while JD Sports scores -0.3. On the other hand, JD Sports’ Quality score (a net measure of whether consumers think the brand represents good or poor quality) is 2.6 – 15.7 points higher than Sports Direct’s score.

While it’s clear that both of these brands have carved out a specific niche and have tailored their customer experience to suit them, the coronavirus crisis has played to JD Sports’ strengths. With a strong online presence and a customer base that is more likely to primarily buy their shoes and clothes online (41%, vs 36% for Sports Direct) JD Sports hasn’t been impacted by shut stores and lockdowns as much.

The growth of the athleisure and loungewear trend during lockdowns has also allowed JD Sports to appeal to their trend-conscious customer base. JD Sports customers are more likely to say they like to keep up with current fashion trends (39% vs 24%) and with six in ten likely to purchase sports clothes (61%) and sports footwear (63%) in the next 12 months, it’s unsurprising that they’re predicting to exceed profits.

Image: Getty