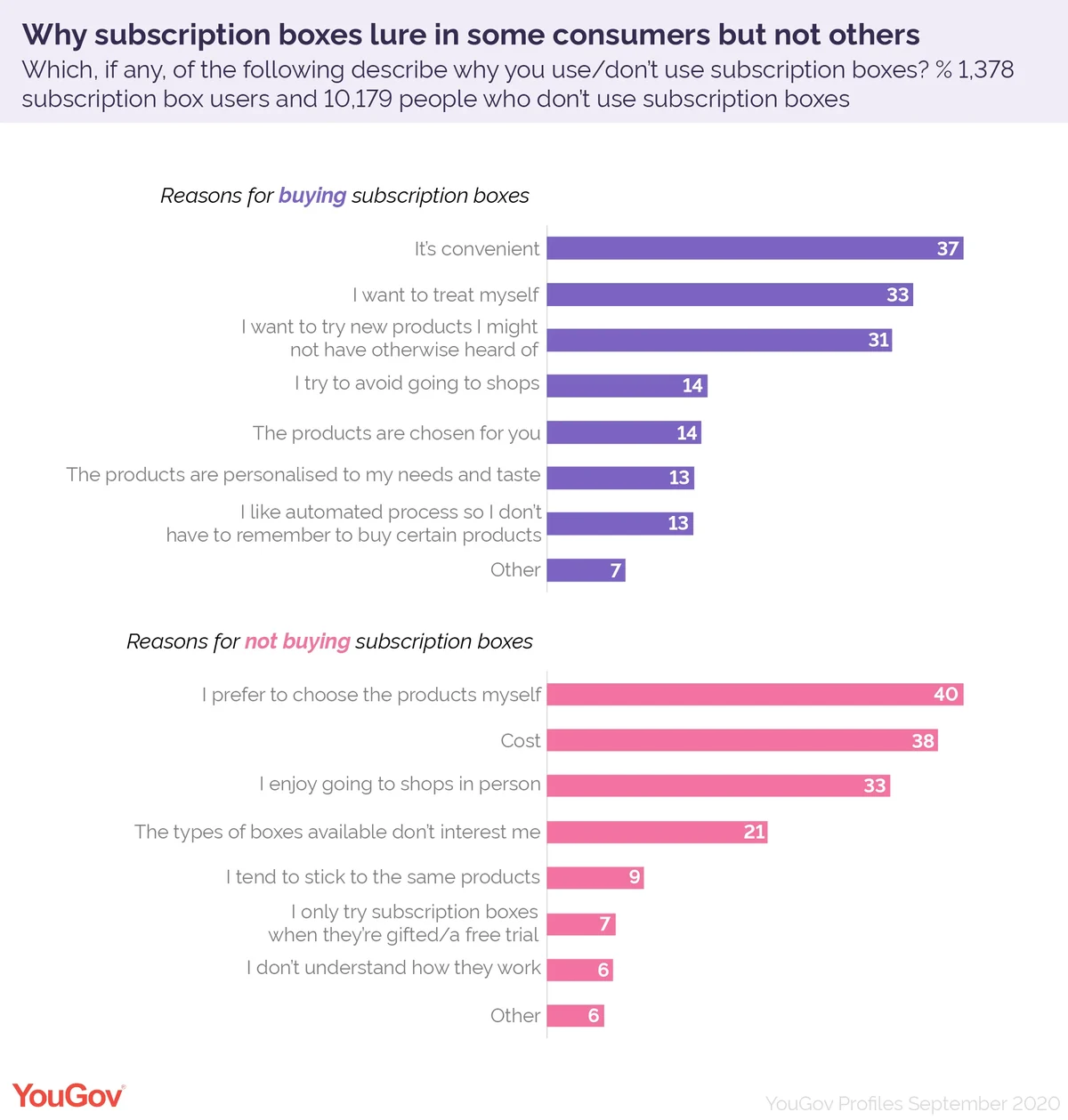

Subscription box fans cite convenience as the most appealing aspect, while cost puts off many other consumers

About one in seven people (14%) have bought from a subscription box company in the last twelve months, with snacks and drinks (33%), meal-in-a-box ingredient services (22%) and make-up and beauty products (20%) being the most popular types.

About two in five subscription box users (37%) cite convenience as a reason for signing up. A third (33%) say they want to treat themselves, while about three in ten (31%) do it to try new products. And one in seven people (14%) simply sign up to avoid going to the shops. The data is from the last twelve months, meaning it's recorded before and during the pandemic.

Despite growing popularity, subscription boxes have not yet caught on with most Brits (84%). Many say it’s because they prefer choosing their own products (40%). A similar number are put off by the cost (38%), while a third (33%) actually enjoy going to the shops. A fifth (21%) also say the types of boxes currently on offer don’t interest them.

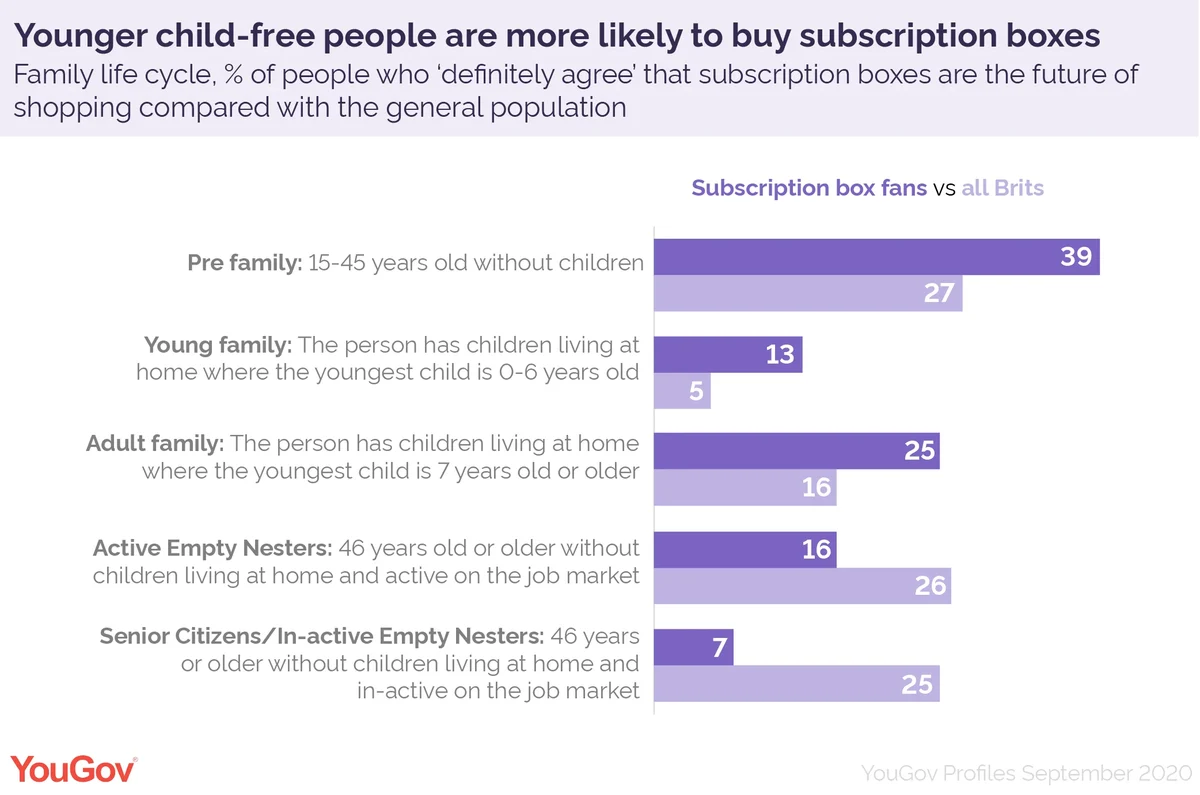

Younger people are more susceptible to subscribing to a box

Subscription box fans tend to be male (59% vs 49% of all Brits) and are often younger. About half are millennials (53%), and they are more likely than the wider population to not yet have had children (39% vs 27%), have a young family (13% vs 5%) or an adult family (25% vs 16%). The wider population is, on the other hand, more likely than box customers to have adult children who’ve moved out.

Social grade also plays some role. About three in five subscription box users (59%) are ABC1s, meaning they’re more likely to work in professional jobs. This compares to 54% of all Brits.

Their advertisement habits also differ from the rest of the population. About one in seven (15%) like adverts on influencer blogs or vlogs, while only 4% of the public agree. Promotions on podcasts (11% vs 4%) and online advertising in general (28% vs 20%) also perform better with this segment.