Brits are happy to levy more money from rich people, businesses, tobacco and alcohol, but want inheritance tax and fuel duty cut

This week's Budget has been overshadowed by the issue of the coronavirus, but despite that the new Chancellor will still have to make the usual decisions on taxes for the year ahead. In the run up to the Budget we looked at public attitudes towards the changes that the Chancellor could make.

Tax cuts and tax hikes

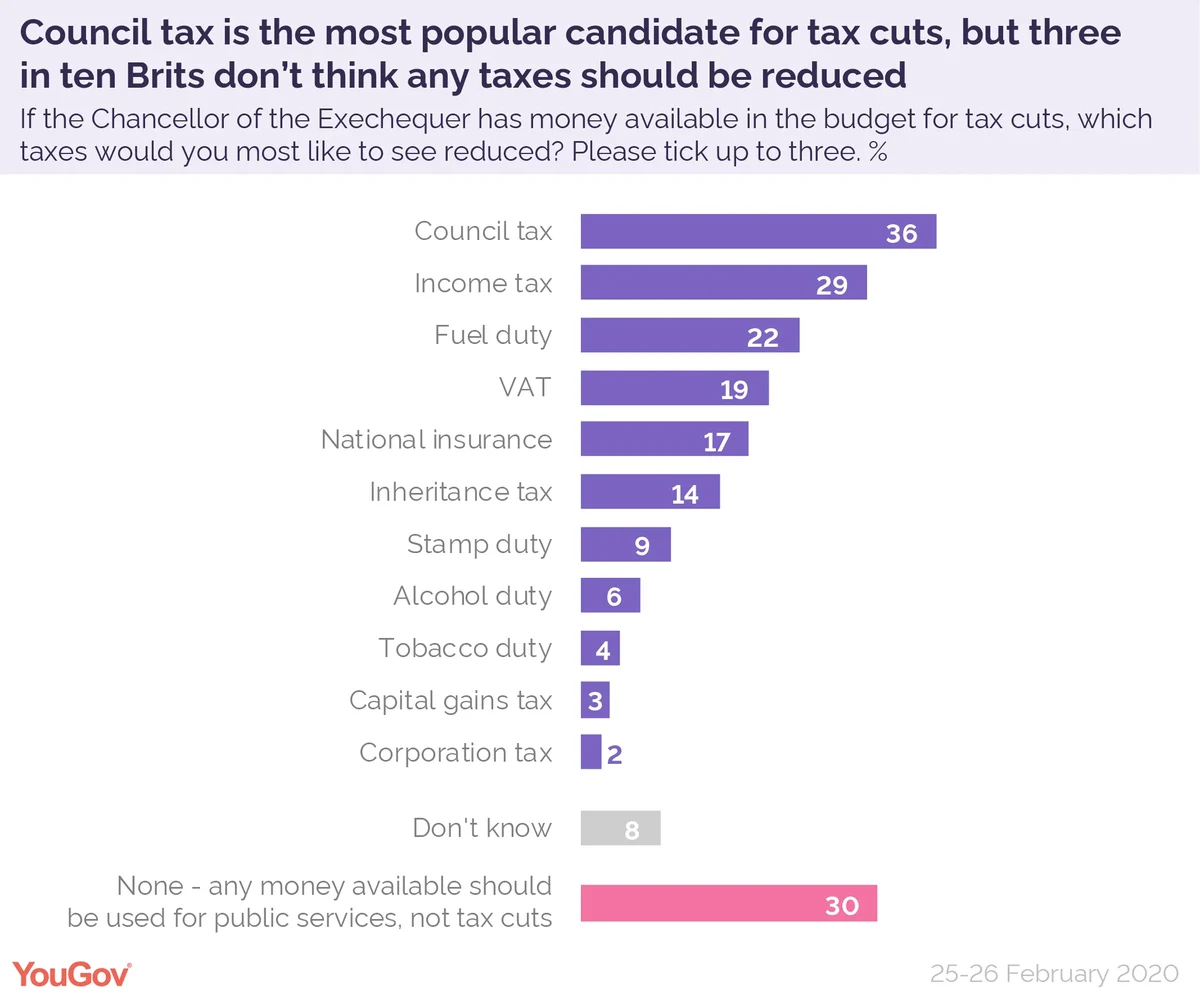

If the Chancellor has money to spend, the most popular tax reduction would be to cut council tax (picked by 36%), followed by income tax (29%) and fuel duty (22%). Three in ten reject any idea of tax cuts, and would rather the Chancellor spent any spare cash on public services.

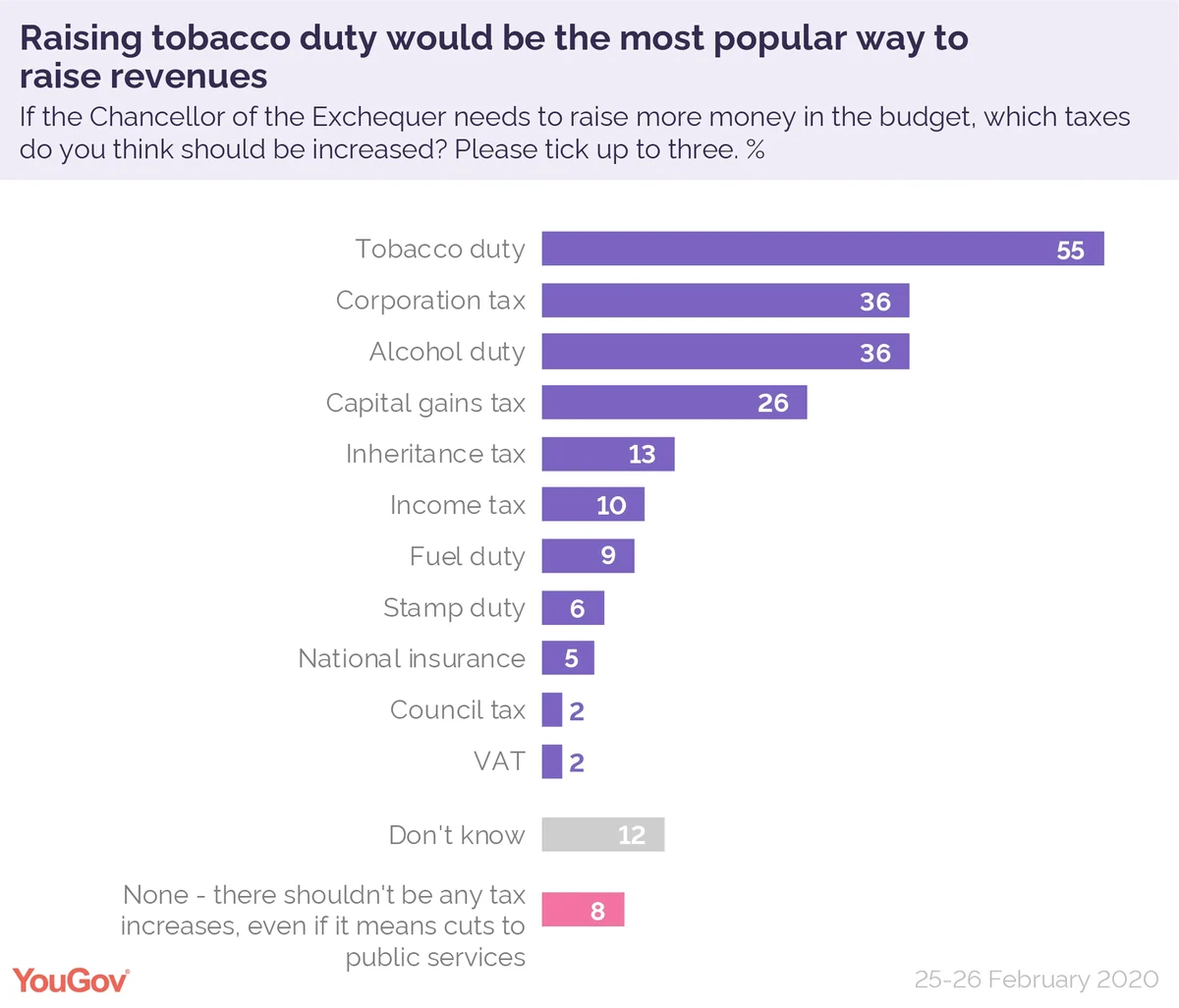

If, on the other hand, the Chancellor needed to raise more money in the budget, the most acceptable tax rises were tobacco duty (55%), corporation tax (36%) and alcohol duty (36%). About one in twelve Brits (8%) reject any tax increases at all, even if it means cuts to public services.

"Sin taxes" and petrol taxes

The least unpopular taxes remain the so-called "sin taxes", presumably because for many people who do not smoke, or drink relatively little, they are taxes that are only paid by other people, or which can theoretically be avoided by not drinking or smoking.

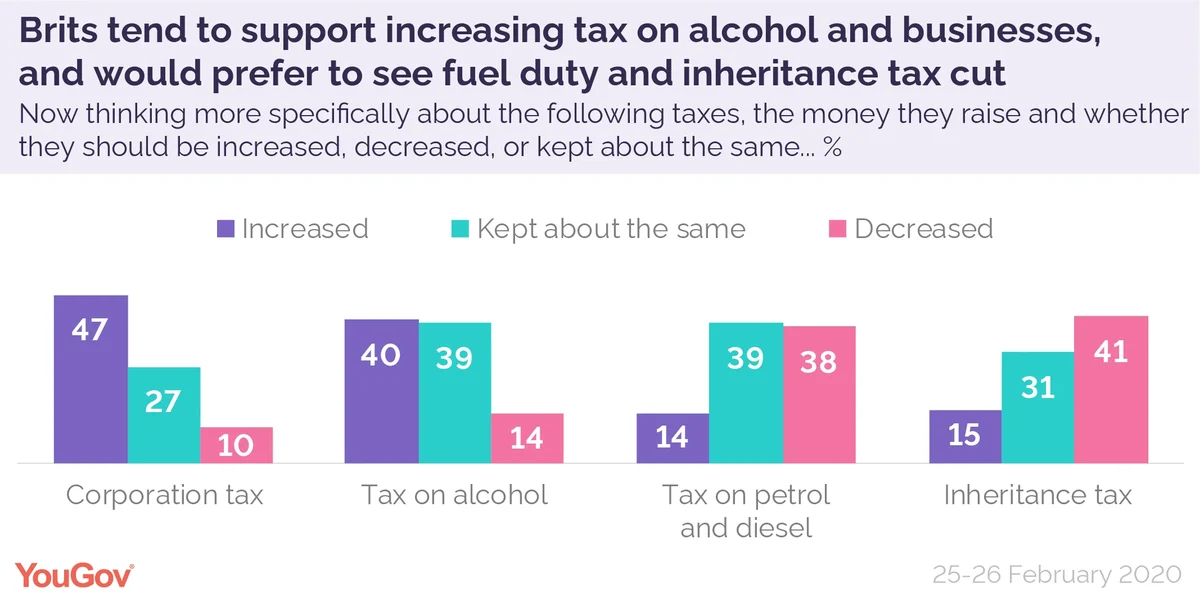

There is sometimes a perception that tax on alcohol is unpopular and Chancellors will often flourish a reduction or freeze in beer duty as if it is a crowd pleaser. Polling suggests that public opinion is more nuanced. Asked specifically about alcohol duty 40% of people would like to see the level of tax on alcohol increased, 39% kept the same and only 14% decreased.

Of course it is possible that there is still an electoral advantage to parties in cutting beer duty (it may be that the 14% who support a cut are regular drinkers who genuinely have strong feelings, while the 40% who oppose it drink little and care little whether it is taxed or not).

In contrast the polling does indeed support the idea that fuel duty is unpopular. Almost four in ten (38%) would like to see fuel duty decreased, 14% increased and 39% kept about the same. It is also an issue where there is a genuine regional disparity - Londoners are neutral towards fuel duty, but people in the Midlands and North are far more favourable to a cut.

Business taxes

Business taxes may also fall into the category of taxes that are seen as being paid by "other people". Approaching half of people (47%) think that corporation tax should be increased, 10% decreased and 27% kept the same. Even among Tory voters the balance of opinion is in favour of higher business taxes.

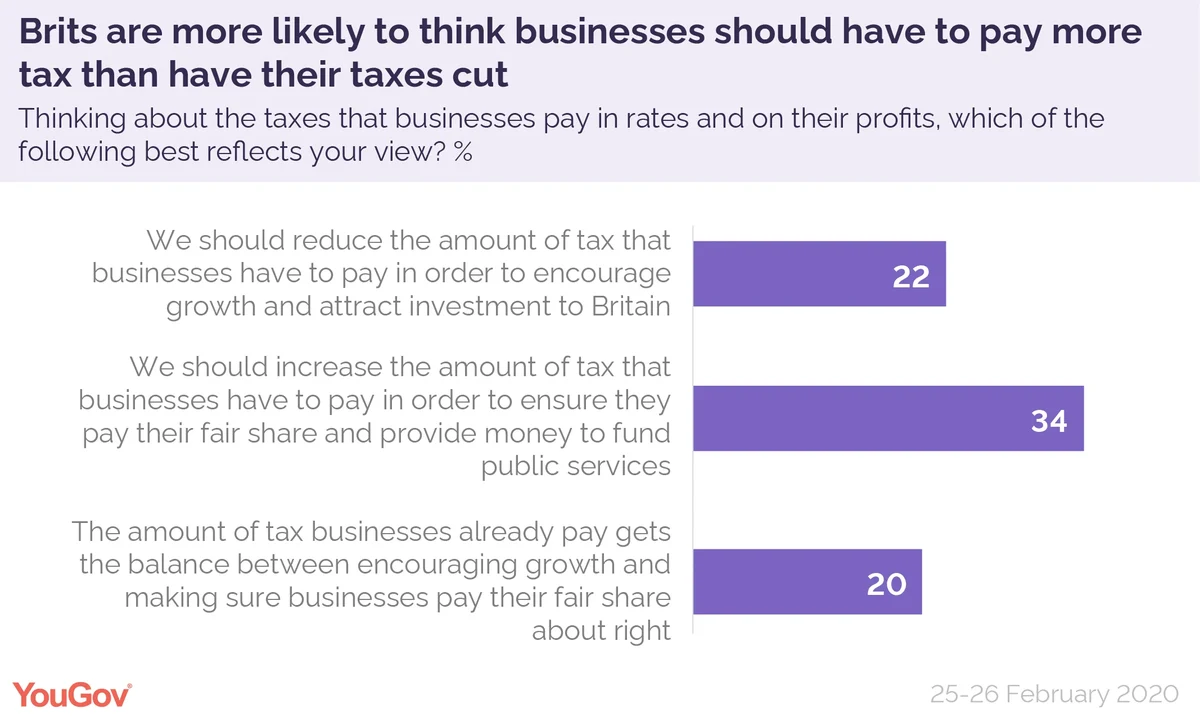

The argument that the Conservative party has put forward over the last decade to justify cuts – that corporation tax is a way of attracting business and investment to Britain – narrows this gap a little, but still leaves the public opposed. When asked, 22% would rather we reduce the taxes that business pays in order to attract investment and encourage growth, while 34% would rather we increase business taxes so they contribute more to public services.

Pensions

One controversial measure that the Chancellor could adopt, and which was being heavily trailed earlier in the year, was a reduction in tax benefits for pension contributions for higher earners. An increase in taxes on money paid into pensions by those earning over £50,000 would be supported by 45% of people and opposed by only 20%.

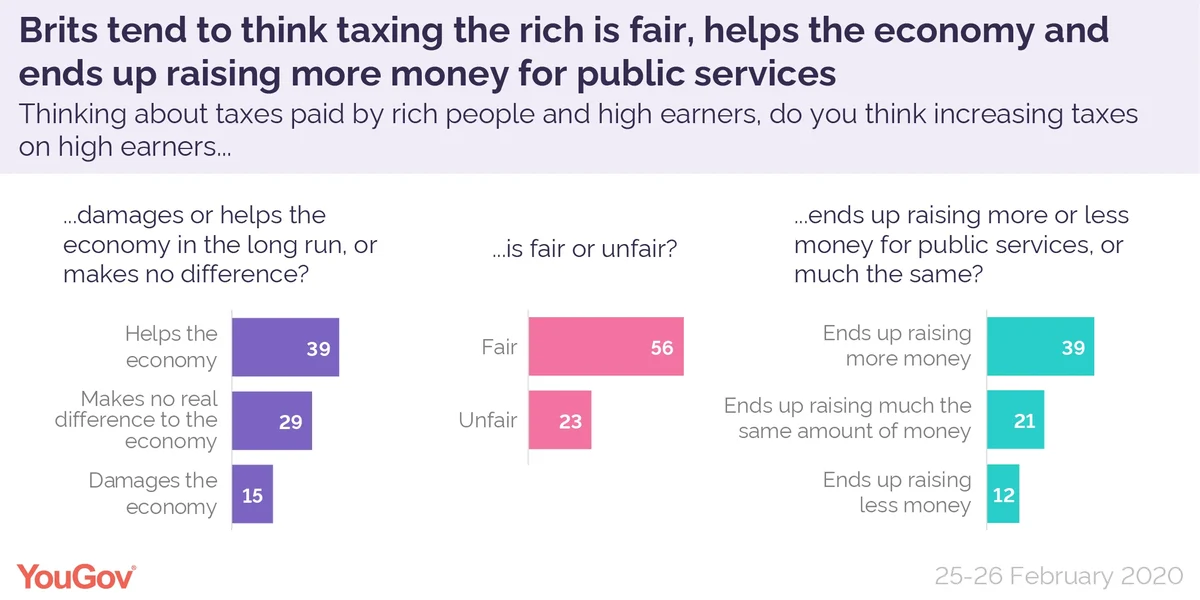

Increased taxes on the rich are seen as fair and workable

As a rule, people are almost always supportive of increasing the amount of tax paid by people significantly richer than they are. This seems to remain the case. By 56% to 23% people think it would be fair to increase the amount of tax paid by rich people and high earners.

Similarly, arguments that increased rates of tax on high earners are damaging to the economy or end up raising less money fall on deaf ears - by 39% to 12% people think that increasing taxes on the wealthy brings in more money rather than less. By 39% to 15% people think higher taxes on the rich helps, not damages the economy.

The contradiction of inheritance tax

Inheritance tax is, by definition, only paid by people who have at least £325,000 in assets when they die. This means it is only paid by around 5% of estates. As a tax that impacts only the relatively wealthy we might expect it to be popular - but polling consistently finds it isn't.

Our latest poll is no different: 41% of people would like to see inheritance tax cut and only 15% increased. One in three (31%) would prefer it to say at the current level. This appears to be linked to the view that inheritance tax is unfair - in other recent polling we found 47% thought inheritance tax was unfair and only 23% fair, far worse than taxes on income, travel or the "sin taxes".

Whether this is because it is seen as a tax on dying, or taxing wealth that had already been taxed is unclear, but inheritance tax remains an unusual example of a tax that mainly hits the rich, but still manages to be unpopular.

Photo: Getty