Loyalty programmes are one of the most common marketing instruments used by retail brands. While most schemes are built to incentivise repeat custom and capture data, we’ve also identified a strong side-benefit. A significant proportion of customers say they are more likely to recommend a brand once they are a member of its loyalty programme.

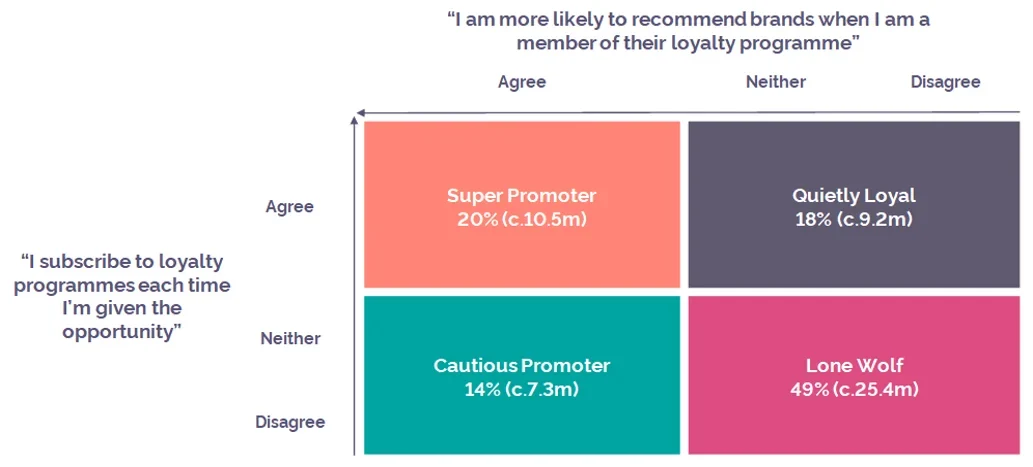

Using data from YouGov Profiles, YouGov has developed a framework to explore this tendency. The framework drills deeper to understand the make-up and general traits of core consumer groups, which are defined on the basis of their likelihood to subscribe to loyalty programmes and to recommend brands.

Before we proceed further, let’s define each group of consumers.

Super Promoter: This group subscribes to loyalty programmes each time they are given the opportunity and are more likely to recommend brands when they are a member of their loyalty programme.

Quietly Loyal: This group features consumers who subscribe to loyalty programmes each time they are given the opportunity but aren’t more likely to recommend those brands.

Cautious Promoter: While this group is a little more choosy - they don’t subscribe to loyalty programmes each time an opportunity comes up - Cautious Promoters are more likely to recommend brands whose programmes they are subscribed to.

Lone Wolf: This category, which represents almost half the British population, features those who don’t readily subscribe to loyalty programmes and nor are they more likely to recommend the brands that they subscribe to.

Super Promoter

Making up one-fifth of the British population (20%), the composition of this group is younger than the national average. Four in ten (42%) Super Promoters are millennials as compared to three in ten among the national population (32%).

Members of this group pose a unique challenge to marketers. While they are likely to both subscribe to loyalty programmes and recommend the brands they are subscribed to, they can also be swayed towards other brands. For example, more than four-fifths (84%) of them, compared to 70% of the overall population, say they will buy from a brand that is on offer over their favourite brands.

One in two ‘Super Promoters’ enjoys visiting shopping centres in their free time (51% vs 42% nationally) and they are almost twice as likely as the national population to spend heavily on clothes (35% vs 19%).

Quietly Loyal

Women make up almost two-thirds (64%) of the ‘Quietly Loyal’ group, which is 12 percentage points higher than their presence in the overall population. What’s more, over three in ten consumers (32%) in this category are Baby Boomers, compared to only a quarter of the national population (26%).

These consumers also tend to be more inclined than the general population to utilise sales, coupons, and deals (75% vs 64%). Almost all of them are also likely to be on the lookout for special offers (90%), compared to 83% of all British adults.

Interestingly, ‘Quietly Loyal’ consumers are markedly more likely to be subscribed to a pharmacy loyalty programme (47% vs 28% nationally). A slightly quirky insight about this group is that they show a much stronger preference than the national population for consuming squash and cordials (24% vs 14%).

Cautious Promoter

If Super Promoters are the group that marketers can target to expand their customer base, Cautious Promoters are the group that will help them maintain one. Three-quarters of members of this group (76%) say they are more faithful to brands they are a loyalty member of, as compared to 41% of the national population. The segment features an over-representation of males at 56%, compared to 48% at a national scale. Millennials constitute more than two-fifths of this group (43% vs. 31% nationally).

This group are also modern tech-savvy. Eight in ten (82%) say they are heavy social media users compared to seven in ten (72%) of the national population. They are also far likelier to have a gaming console at home (43% vs 32%).

Download the full framework and audience profiles

Methodology

The market size for this framework was calculated using a total adult (18+) population in Britain of 52.4m. Data is based on average responses from the year up to 20th June 2021 to the following question:

To what extent do you agree with the following statements?

- I subscribe to loyalty programmes each time I’m given the opportunity

- I am more likely to recommend brands when I am a member of their loyalty programme