Last year was challenging for retailers big and small: profit warnings, store closures and job losses made headlines throughout the year. Familiar high street names such as Toys R Us disappeared completely, with many pinning the blame on online shopping.

Despite this, some predominately bricks-and-mortar brands have continued to perform well under the same conditions, such as IKEA, NEXT and Primark.

To find out why some are succeeding while others aren’t, YouGov has used Plan and Track research to investigate the link between consumer perception and a brand’s fortune in its latest whitepaper; ‘Is there still hope for the high street?’

One area of high street retail which has particularly struggled are the familiar, historic department stores such as John Lewis, Debenhams, Marks and Spencer and House of Fraser. The aggressive growth of online rivals with smaller overheads have been hard to compete with, despite the heritage, size and legacy of British department stores.

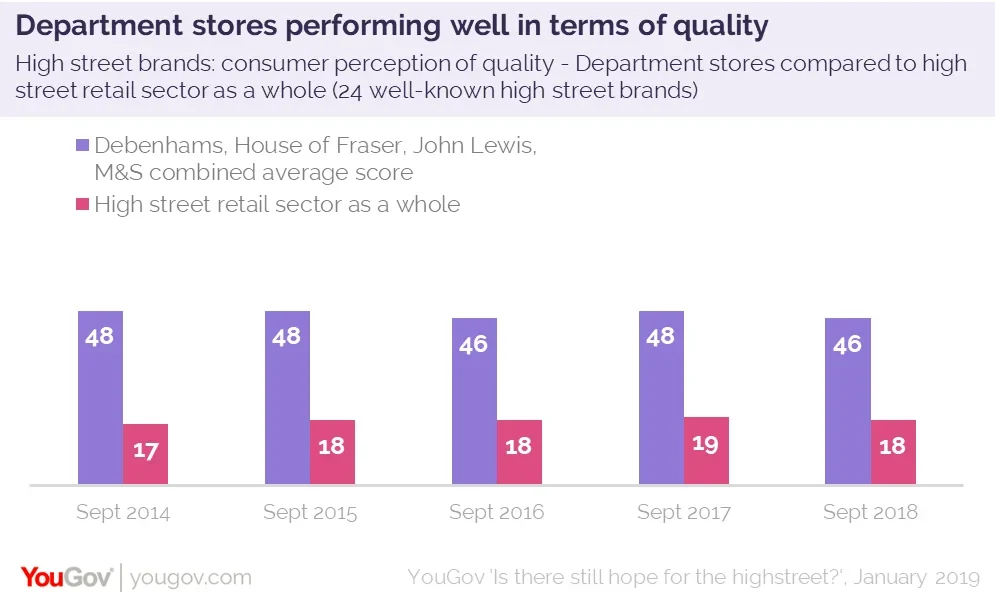

Despite financial woes, department stores have maintained a health consumer perception when compared to the high street retail sector as a whole – particularly in satisfaction and quality.

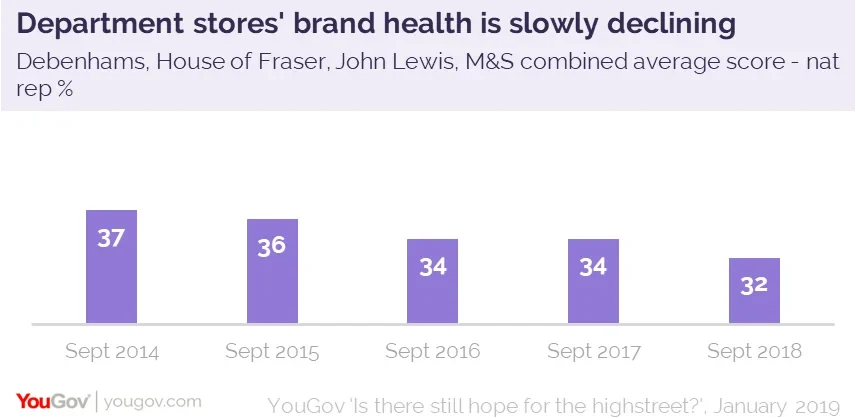

However, overall brand health (including the metrics Impression, Quality, Value, Satisfaction, Recommend and Reputation) have been slowly declining since 2013 due to slipping consumer perception of value for money, which is essential for retailers to retain a customer base. Retailers with the largest drops in quality perception over the past year are Toys R Us (-8), Maplin (-4), Homebase (-4), WH Smith (-3), and House of Fraser (-3), all of which have suffered financial difficulties, store closures or both.

Although these scores are falling, recent customers of any of the four department stores have the highest perception of value, indicating that customers are happy with their experience. The public as a whole though are increasingly likely to think that they no longer offer good value for money.

It’s not all doom and gloom, however; the data indicates that this decline is not necessarily inevitable. There are brands who are bucking the trend and improving value perception in spite of challenges such as increased business rates, a shift towards online shopping and consumers’ changing tastes and expectations.

To read further into how retail brands are faring on consumer perception in such a challenging environment and download our whitepaper for yourself, please click here.