Russell Feldman, YouGov's Technology and Telecoms Director, assesses the prospects for Amazon's new smartphone

Amidst the fanfare around the head-tracking technology and 3D views, one of the important aspects of Amazon’s Fire phone launch was an introductory offer that gives new Fire owners 12 months of Amazon Prime for free.

This offer is at the heart of the strategy Amazon adopted for its tablets. The company sells Kindle Fires at a lower price than many of its competitors, relying on the selling of content to make up any shortfall. The prominence of the Prime offer at the recent Fire launch suggests it is also at the centre of the way it wants to build its phone’s market share.

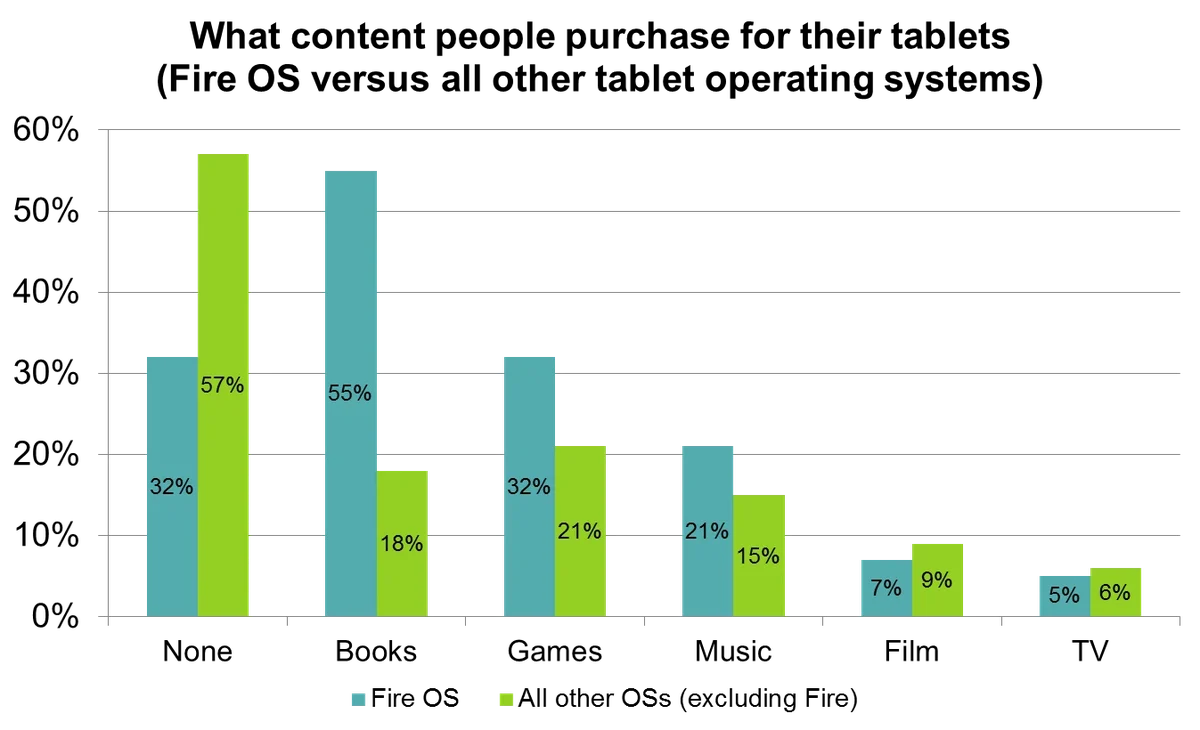

This approach is not surprising given it is starting to work well among Kindle Fire tablet owners. YouGov’s Tablet Track data suggests that among tablet owners, it is those on Amazon’s Fire OS that are the most likely to purchase a variety of content. Unsurprisingly, it is well ahead of the field in terms of the percentage who buy books. However, Fire OS users are also more likely to purchase games for their devices (32% to 21% for all other operating systems) and music (31% versus 15%).

It is also true that Fire OS users are also the cohort less likely to not purchase any content for their device than owners of the other tablet OSs. Only a third (32%) of people using Amazon’s OS have not purchased any content compared to over half (57%) of other tablet users.

However, for the Fire phone Amazon’s strategy looks as though it is at once both more niche and broader than its approach to building its tablet base.

- It is more niche as while the Kindle is a mass-market device aimed at everyone, the Fire phone is a quality piece of kit targeted at people who like high-end devices.

- Yet it is also broader as it is trying to use the phone to sell more than just content to be used on the device itself – moving on from shifting books and games to selling everything available through Amazon and using the phone as a one-stop shop in the pocket.

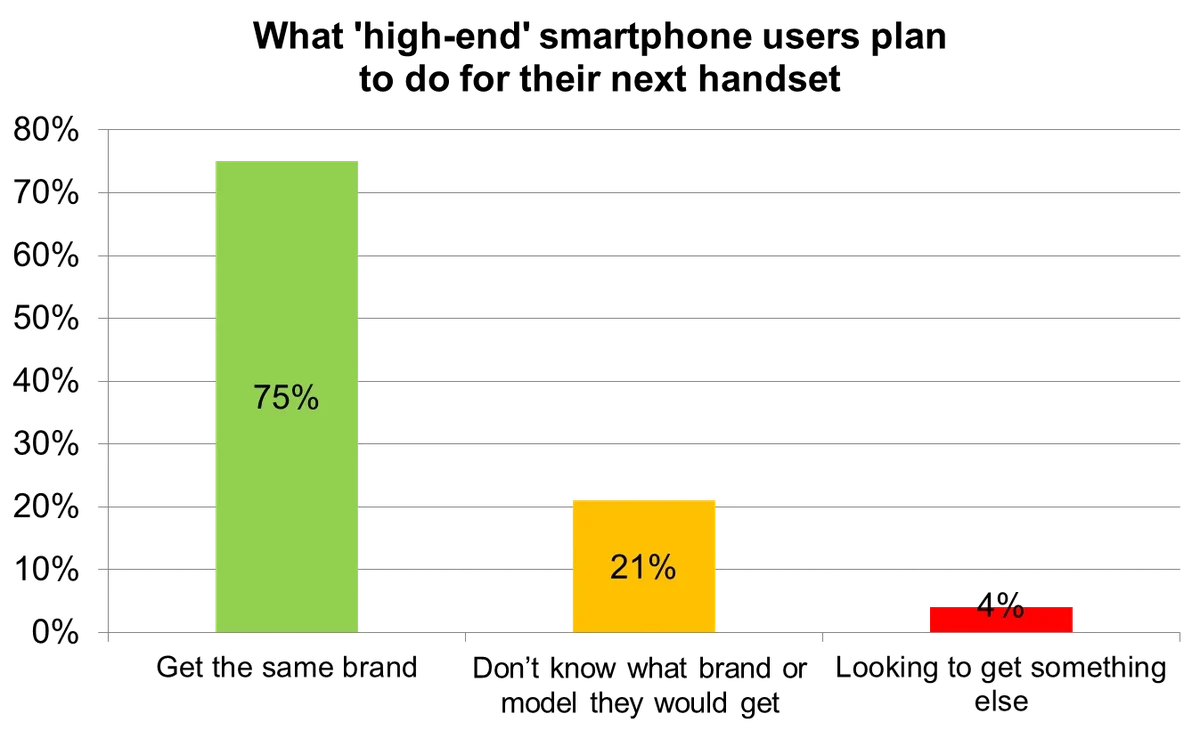

On the first issue, the tricky part for Amazon is that while the Kindle Fire tablet is aimed at the mass market, the Fire phone is aimed squarely at the high-end user. Our most recent smartphone tracking data (SMIX) shows that users of these latest high-end devices (such as the iPhone 5S, Samsung Galaxy S4 and S5, Lumia 1020, etc) make up just over a quarter (26%) of the smartphone market.

Among this group, 75% expect to get the same brand of high-end phone next time they upgrade their device. A fifth (21%) currently don’t know (they may be waiting to see if Apple launch a new iPhone before they decide, for example) and just 4% say they are planning on switching to a different type of handset. This shows the difficulty of breaking into a fiercely loyal market.

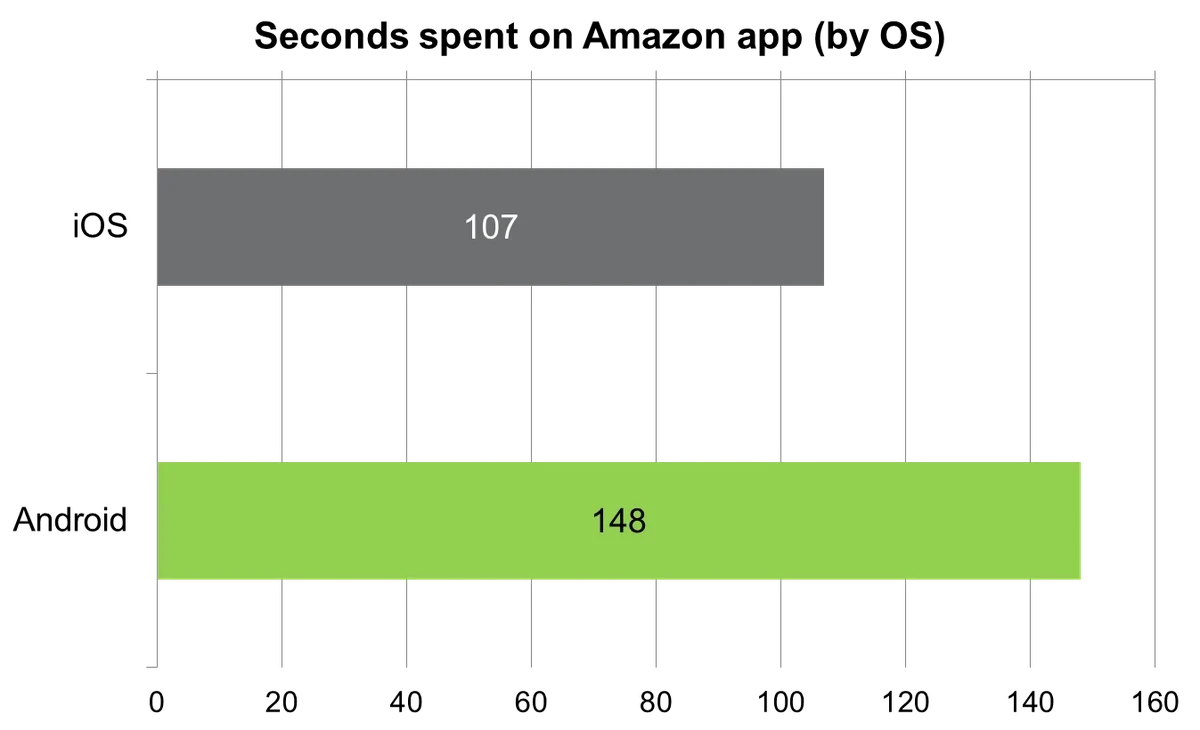

If Amazon’s strategy to set itself apart from the competition is for its phone to be a one-stop shop in the pocket, will it work? We measure people’s day-to-day smartphone use with our Pulse passive behavioural tracking software. We found that 28% of smartphone owners have opened the Amazon app in last 12 weeks. For those on iOS the average session length is 1 minute 47. On Android it is 2 minutes and 28 seconds. Given the use of the Amazon app, will people really want to buy a phone that fills the same role, albeit in a turbo-charged way?

The offer of free Amazon Prime is part of this and is a clear expansion of the firm’s Kindle strategy of upselling device owners a wide range of content. The Fire phone is explicitly a purchase device, designed to drive owners to buy in one place. It worked for the Kindle Fire so maybe it will also work for the Fire phone.

However, serious questions remain that will determine the device’s success. Given it is aimed at the very loyal high-end market, will 3D technology and free introductory offers be enough to shift consumers away from their existing devices on to an Amazon smartphone? Will consumers want the device given so many of them already use the Amazon app on their existing phones within their existing ecosystems. If the answer to either is “no”, Amazon could be left with a lot of stock gathering dust in stockrooms.

This article originally appeared in Mobile magazine

Image from Getty