YouGov/Cebr’s Consumer Confidence Index has fallen for the first time in a year.

The Index decreased from 110.0 in November to 109.5 in December. The figures show that while people remain optimistic about the UK housing market after a year of robust growth in the price of bricks and mortar, consumers are still concerned about their personal economic situations.

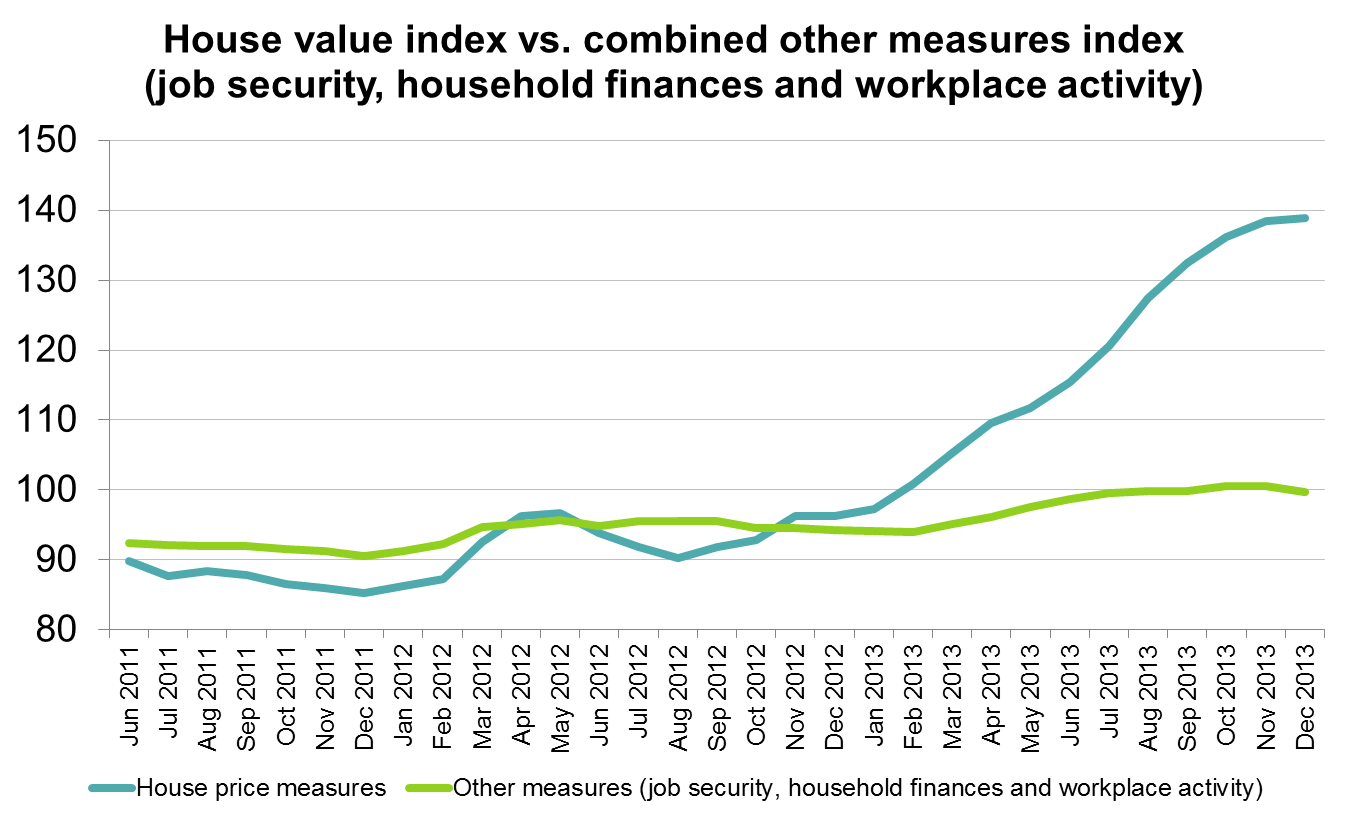

The fall in the Consumer Confidence Index comes as new analysis of YouGov’s economic data shows that property prices have greatly inflated consumer confidence over the last year. Positive feelings about the state of the property market have become increasingly ubiquitous in 2013, as reflected in the +43.7 point rise in the house price index since January. However, sentiment in other important areas – job security, household finances and workplace activity – has risen by just +5.2 points in the same period. By contrast, during the 18 months leading up to January 2013, the house price index scores topped these other measures on just four occasions.

YouGov/Cebr’s findings appear to support Bank of England Governor Mark Carney’s decision to phase out the Funding for Lending scheme for mortgage lending and instead refocus it towards business lending. The Governor’s move was a bid to prevent the housing market from overheating and support a wider business-led recovery.

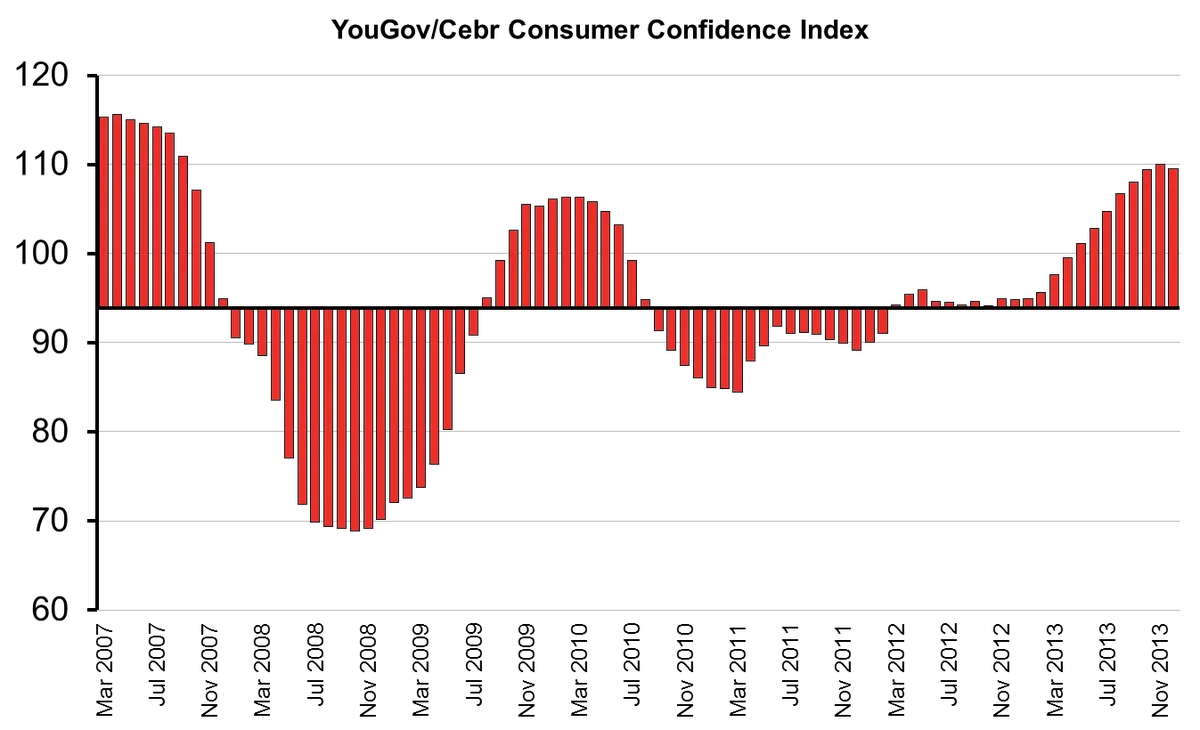

YouGov/Cebr Consumer Confidence Index

YouGov/Cebr’s Consumer Confidence Index for December shows UK households’ economic optimism decreased for the first time in 12 months.

The Index – based on YouGov’s Household Economic Tracker (HEAT) data – fell -0.5 points over the last month, declining from 110.0 in November to 109.5 in December. This is the first fall in the headline score since December 2012. Although consumer confidence is +14.7 points above where it was this time last year, it is still -6.1 points lower than it was in spring 2007 before the financial crisis hit.

Source: YouGov/Cebr HEAT data, December 2013, using a three-month rolling average.

Notes: Axis value of 93.9 represents the average HEAT Consumer Confidence measure since the data set began in 2007.

Resurgent housing market has driven consumer confidence values

The decline in the Consumer Confidence Index comes as YouGov’s HEAT data shows the extent to which the surge in people’s economic optimism over the past year has been driven by rising house values. Since December 2012, consumers’ perceptions of the change in house prices have risen by +42.6 points, from 96.3 in December 2012 to 138.9 a year later.

The large improvement in the housing measures hides a much slower rate of increase in the other measures that make up the Index. Since December 2012, the average combined scores for job security, household finances and business activity in the workplace have gone up by just +5.4 points, from 94.3 to 99.7. A score below 100 means that more people are pessimistic than optimistic, implying that presently consumers still have underlying concerns about the extent to which the economic recovery is having a positive impact on their day-to-day lives.

Source: YouGov/Cebr HEAT data, December 2013, using a three-month rolling average.

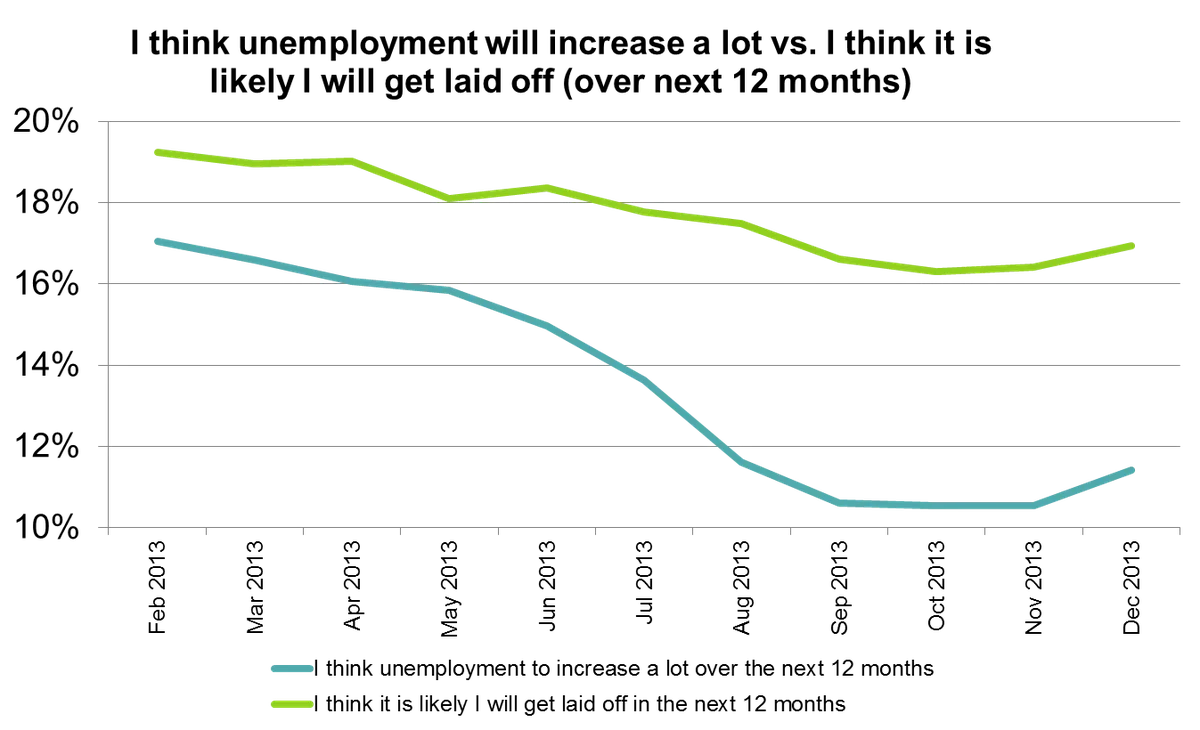

While the measures for job security, household finances and business activity in the workplace have all improved over the past year, the increase in these indices of consumer sentiment has been more modest. YouGov’s tracking data also suggest that while people believe the economy in general is picking up, they have yet to fully feel the benefits in their own lives. Although the number of consumers thinking unemployment will increase a lot over the next 12 months has fallen 5.6 percentage points (from 17.0% in February to 11.4% in December), people’s own fears of being laid off in the next year has fallen by just 2.3 percentage points (19.2% to 16.9%) during the same period.

Source: YouGov/Cebr HEAT data, December 2013, using a three-month rolling average.

Stephen Harmston, Head of Syndicated Reports at YouGov, said: ‘This month’s fall in consumer confidence highlights the fact that the economic recovery is far from being a done deal in the eyes of many people. The surge in house prices in the last year has inflated consumer confidence, masking the underlying economic fragility in people’s day to day lives. Although there has been a general improvement across the board during 2013, more consumers are still more pessimistic than optimistic in areas like job security and household finances. It is clear from these figures that there is still some way to go before people feel the recovery in their wallets.’

Charles Davis, Associate Director at Centre for Economics and Business Research, said: ‘Consumer confidence has been on an upward trajectory for most of 2013 but, significantly, we have now seen the first drop in 12 months. The buoyant housing market has driven much of the gain in consumer confidence but consumers perceive a slight slowdown in the rate of acceleration in the property sector. This could be partly down to seasonal factors but is also likely to be a consequence of Bank of England Governor Mark Carney’s announcement that the Funding for Lending scheme will be phased out of the mortgage market and focussed on business lending. Moreover, the ongoing concern is that beyond the housing market, this recovery isn’t yet translating into a sustained, wider improvement in measures of consumer economic sentiment.’

Look here for more information about the Household Economic Activity Tracker