YouGov CEO Stephan Shakespeare assesses the value of networked longitudinal market research

Five years from now, the typical research commissioned today by the typical research department will be remembered with embarrassment as clunky, dim-witted and far too expensive. The smartest are already saying it. One-dimensional studies micro-sliced into 50 PowerPoint slides? Absurd!

People are connected, dynamic, subject to a multitude of simultaneous influences; they are forever toying with their loyalties, and continuously expressing themselves to their friends and to the wider world. "If you don't like change, you'll like irrelevance a whole lot less," says Joe Tripodi, chief marketing officer of Coca-Cola, but that will sound mild: the old-fashioned nostrums of today will be dismissed as mere quackery.

YouGov was the first to do accurate, reliable market research online. We're still the only ones who constantly – and publicly – test and prove our accuracy. But accuracy is only the beginning of the story. What really matters for today's reputation manager is continuous, connected multi-layer data that helps you understand attitudes and changing markets in their dynamic totality. And you can only get that from high-quality, high-response representative panels engaged in a structured, networked programme of longitudinal research.

Quarterly studies? No way: too slow, too superficial. You need to follow your customers, and your potential customers, and all those who continuously co-create your reputation, in all dimensions and every single day because you never know when an opportunity or a threat will rear up in front of you. If something happens to your brand today, will you know what to do about it right away? Or in a week? Or a month?

And here's the punchline: the best research methodology is also cheaper than what you have right now. In-depth, robust, continuous monitoring of change, reported to you in a dynamic indeed beautiful dashboard, actually costs less than those clunky dim-witted annual studies.

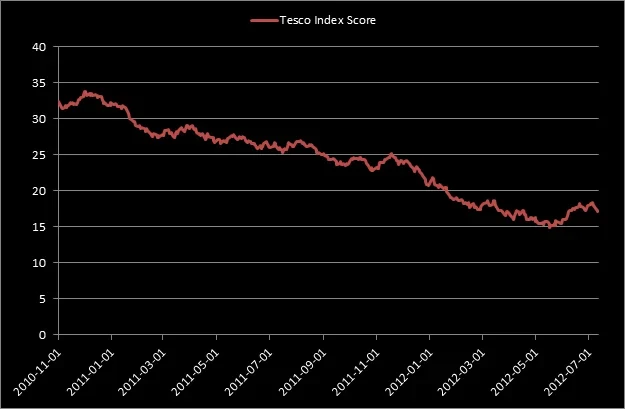

YouGov BrandIndex tracking of Tesco

Above is a graph of the BrandIndex amalgamated image score for Tesco (it looks a lot worse if you only look at the “value” component). It's just a line, but all the people who gave their views to make that line are intimately known to us. Our integrated data-base has at least a thousand things about each of those hundred thousand people. We know their media channels, their full demographics, their attitudes and viewing and buying behaviour, and a whole host of likes and dislikes. Many of them allow us into their personal Facebook pages to see everything they see, and to follow them on Twitter where we analyse every brand message they receive and test its daily effect.

And if they change their attitude to a brand, we can spot that and re-interview them immediately to find out exactly why they've changed, and – for any marketer this is crucial – what exactly can be done about it. Those people who moved from positive to negative about Tesco, maybe just 3 per cent – and we could target them forensically – would tell us exactly why, and long before it was too late.

By the way, the Tesco share price dived a full year after the BrandIndex first dipped. The markets didn't see it coming, nor did Tesco, but I wrote in my CityAM column before Christmas: "For Tesco, dropping behind Morrisons and Asda on value, while also losing ground in other areas presents a problem. Could the sheen have come off the company that has dominated the UK grocery market over the past decade?"

Fellow market researchers tell me: “People don't like data, they want stories.” Maybe some of them do prefer sad stories of the decline of great companies, but my bet is they would prefer to see what's coming and change it before it's too late.

Continuous monitoring, combined with triggered in-depth interviews, to understand the drivers of change, using extensive long-tail profiling, systematic longitudinal surveys, (BrandIndex runs fresh with a new panel every day), and tracking social media specifically through your actual identified customer and stakeholder types – this is the new data-driven, profile-enhanced, leading-edge research methodology that allows you to manage your brand effectively. And, of course, those one-off studies can now be conducted in the context of all that detailed background.

I said it was cheaper too. Because it is semi-automated and uses the richness and efficiency of a large, engaged, pre-profiled panel, getting the fastest, deepest and largest quantity of insight-loaded data actually requires a smaller budget than the old-fashioned techniques that still make up the majority of the research industry.

This month we are loading up the next phase of profiling our panel. If you want to find out more about getting your brand included in the data-base, drop me an email right now at stephan@yougov.com

This article originally appeared in a special report on Brand & Reputation Management, produced by Raconteur Media and published in The Times (UK). For further content by Raconteur Media click here