As LIBOR scandal joins computer glitch issues on news agenda, BrandIndex shows how far brand perception has been hit

Last week the Natwest computer glitch; this week another bank, another crisis and more damage to a brand. The Barclays LIBOR scandal has hit the bank’s brand hard and fast and whilst the impact on customers may be less obvious than for Natwest’s difficulties the trajectory of the crisis on brand perception was very similar.

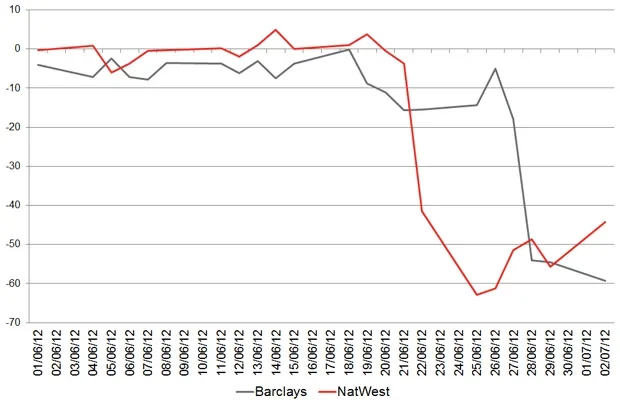

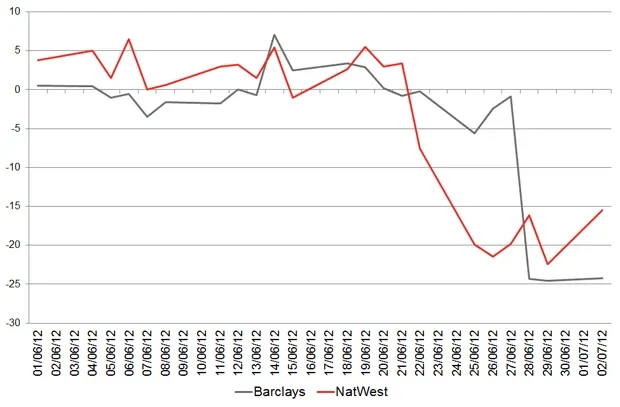

Looking at daily buzz scores on YouGov’s BrandIndex first; both were moving along at just below 0 (heard positive minus heard negative) and then dived – Natwest to -63 on the 25th July, Barclays to -59 on Monday. Hearing bad news is one thing but does it also impact on brand perception? Index scores (a composite of six key image measures) get at that and show a similar pattern. Here, the two brands don’t fall as far but hit lows of -22 for Natwest and -24 for Barclays.

Barclays and NatWest: Buzz

Declines in perception were inevitable but to put those scores into context; at the height of the oil spill disaster in 2010 the lowest one day scores that BP had were -78 for buzz and -19 for Index, so the noise around that crisis was worse then but BP never got as low on brand perception (in the UK) as either of the two banks have. Much ground to recover therefore and the long term impact on them will be determined to a large extent by how quickly they do recover. The brand perception story will develop quickly and Barclays will hope that Bob Diamond’s resignation will be the cleansing they need (YouGov SoMA reveals that news had reached 41% of UK twitter feeds by midday Tuesday).

Barclays and NatWest: Index

One interesting final point – it appears the sector as a whole is being tarred with association; both HSBC and Lloyds have seen their index scores fall at the same time.

This article also appears in City AM