Supermarkets seem to be gearing up for a big push on their own-label products - should brands be concerned?

Last week, Morrisons announced it was bringing back the Safeway brand. Originally a chain of supermarkets that Morrisons absorbed in the mid-2000s, the retailer has decided to launch a new range of own-label goods under the Safeway banner.

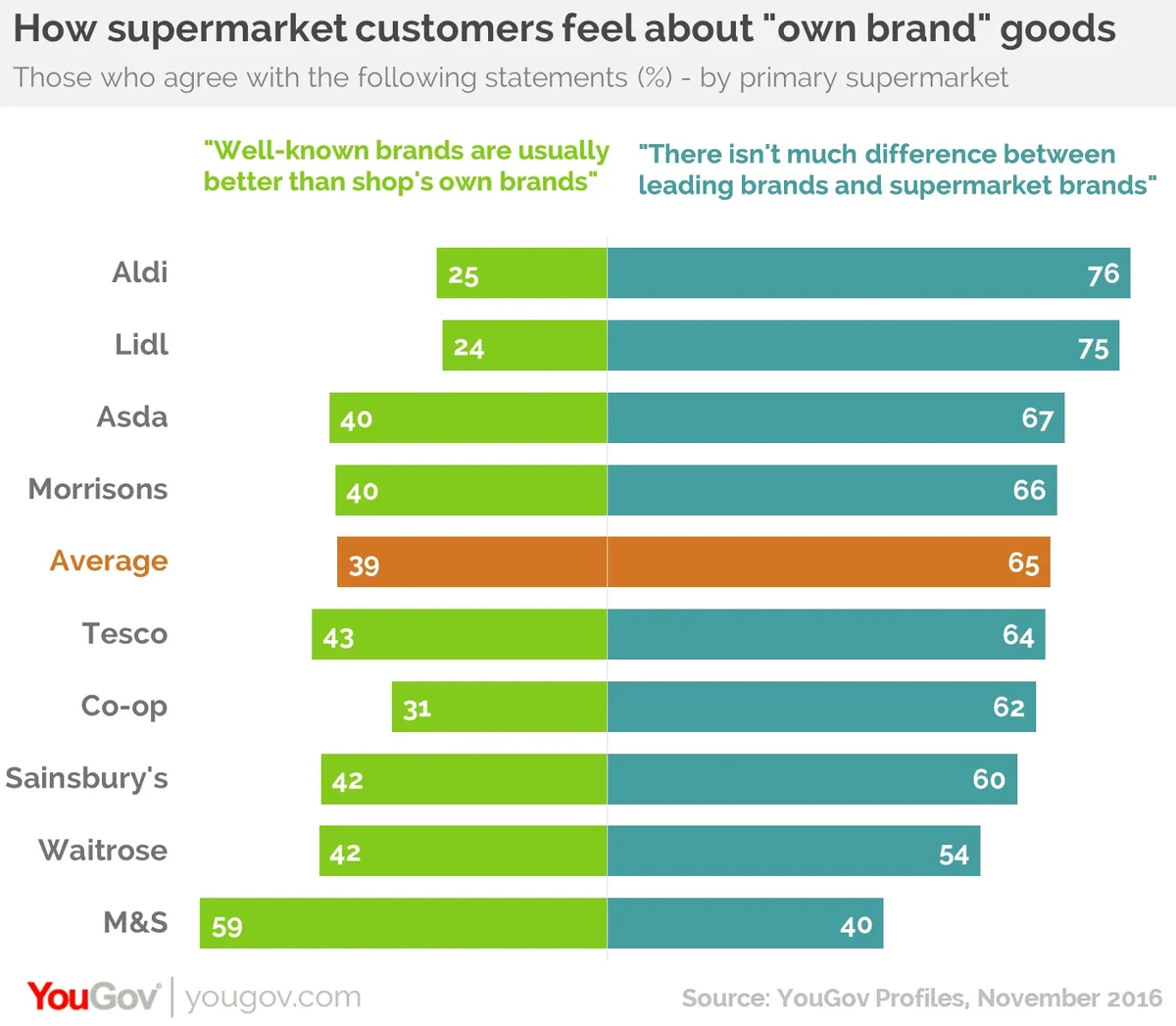

An analysis of YouGov Profiles data shows how shoppers at different supermarkets feel about own-brand goods. (Because consumers were asked whether they agreed with two different attitudinal statements the numbers do not add up to 100.) On average 39% of British consumers believe that well-known brands are usually better than shops’ versions and 65% think there isn’t much difference between branded goods and supermarkets’ own products. For both statements, Asda, Morrisons, and Tesco customers score close to the average.

However there are notable divergences that point to changing consumer attitudes. While only around a quarter of Aldi (25%) and Lidl (24%) customers prefer well-known brands over own-label products, the figure rises to almost six in ten M&S shoppers (59%). The findings are mirrored when it comes to consumers who think that there isn’t much difference between leading brands and own-label goods. Here, around three quarters of people who shop at Aldi (76%) and Lidl (75%) agree, compared to just 40% of M&S customers.

The key question posed by this data is where does the push come from? Is it from consumers choosing certain supermarkets because they like own-branded goods and certain retailers have a stronger proposition when it comes to these value products? Or does it come from retailers having a concerted push on own-label goods in an effort to persuade consumers to switch from branded alternatives?

If it is the former then these attitudes may not affect brands too much. After all, if there is a clear tranche of consumers who favour branded goods over own-brand varieties then there is a high chance that they will stick with their established habits. However, if it is the latter – and the thing that tips consumers from the branded to the unbranded column is simply exposure to the products – then brands could be facing a bit of a challenge.

Morrisons’ resurrection of the Safeway for its own-brand offering is a signal that supermarkets are gearing up for a big push on these products. Such a move makes sense. Not only would it lead to increased margins but it would also hand them notable bargaining power when negotiating with suppliers, something of increasing importance to consumers in light of expected inflationary pressures.

Clearly supermarkets believe that consumers are on their side on this issue – and our data suggests that for most retailers this is true.

This article originally appeared in City AM

Find out more about YouGov Profiles

Image from PA