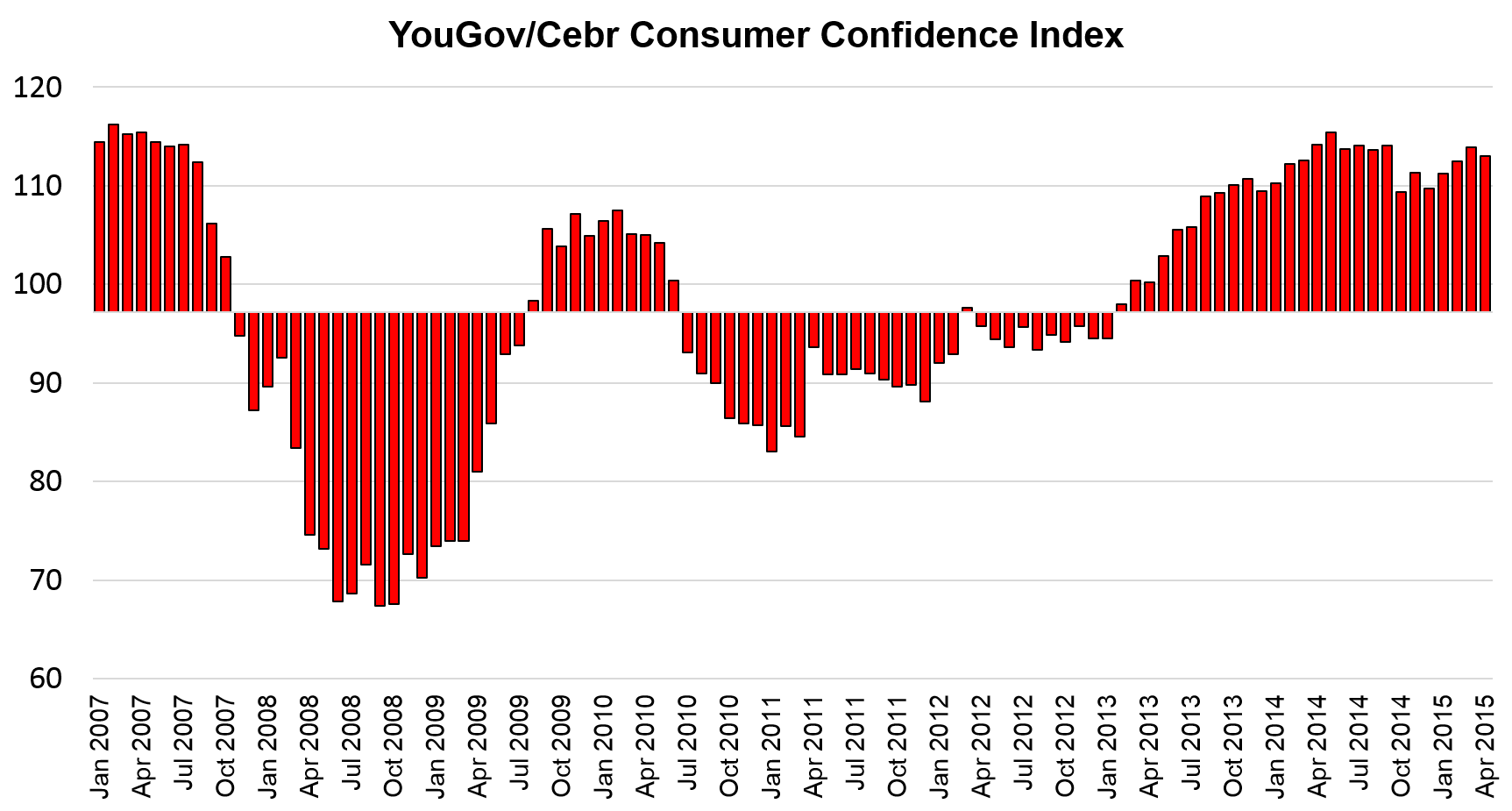

- First fall in consumer confidence since December

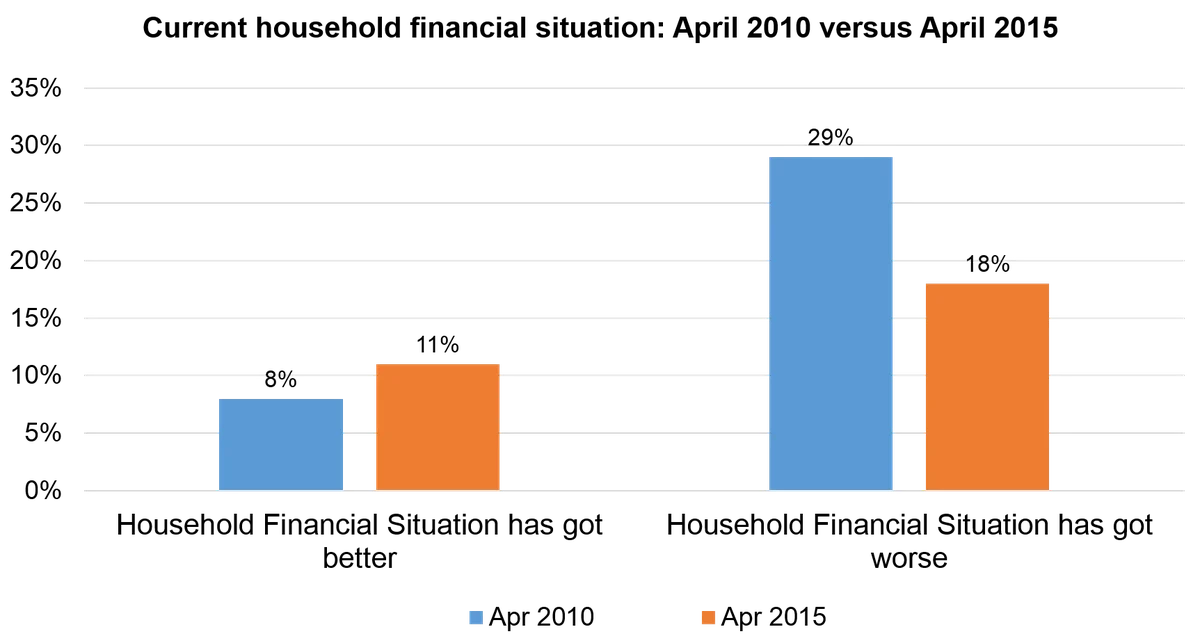

- Consumers’ household financial situations have improved in five years since coalition came to power

- But more still feel they are getting worse off than feel they are getting better off

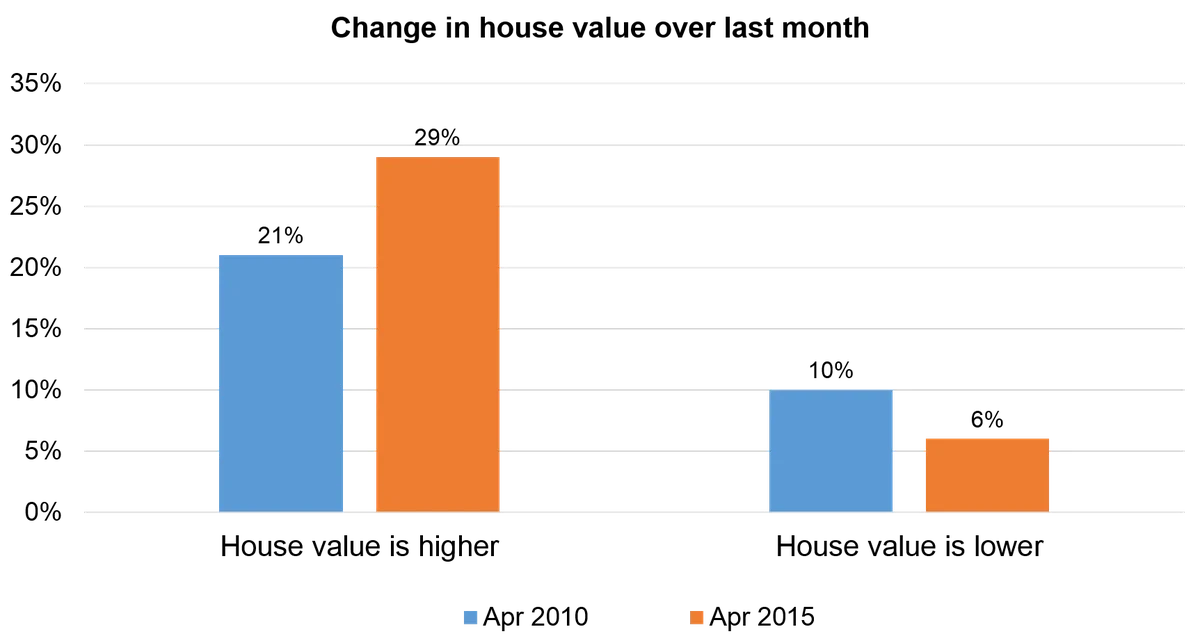

- Property prices have been predominant driver of improved consumer confidence over past five years

Source: YouGov/Cebr HEAT data, April 2015

Notes: Axis value of 97.2 represents the average YouGov/Cebr Consumer Confidence Index score since the data set began in 2007.100 represents a neutral score.

Consumer confidence in the UK has dipped ahead of next week’s general election, new figures from YouGov and the Centre for Economics and Business Research show. The headline Consumer Confidence Index fell from 113.9 in March to 113.1 in April – the first fall since December. It is more than a point lower than it was this time last year when it was 114.2.

With the general election just days away, YouGov has looked at how different measures compare to five years ago – just before the coalition came to power. In April 2010 the headline Consumer Confidence Index stood at 105.0, more than eight points lower than it stands now.

Households’ financial situations have got better since April 2010. However, there is a slight ambiguity about what “better” means. There is some power to the argument that people’s situations have got notably “less worse” instead of them improving radically. In the last five years the share of households saying their situations have got better has risen by three percentage points from 8% to 11%. Yet over the same timescale the percentage saying their household financial positions have got worse has decreased by 11 percentage points from 29% to 18%.

Source: YouGov/Cebr HEAT data, April 2010 and April 2015

The situation about house prices is more clear-cut – improved property values have been the main driving force in improved consumer confidence over the past five years. When compared to April 2010 there has been an eight percentage point change (from 21% to 29%) in the number of homeowners who think their property’s value has increased over the preceding 30 days. This compares to a four percentage point drop (from 10% to 6%) in the proportion who saw their house values decrease. It should be noted that some of the heat has come out of the housing market in the past year and in April 2014 the proportion who said their house value had gone up stood at 43%.

Source: YouGov/Cebr HEAT data, April 2010 and April 2015

Stephen Harmston, Head of YouGov Reports: 'With the election just over a week away, the dip in consumer confidence has come at exactly the wrong time for the government. As the GDP figures slowdown, it is clear that consumers still feel as though the recovery is fragile and that many of them are not feeling it in their wallets.

'Looking back over the last five years, the general trajectory for all our measures has been upwards. However, while some – such as house values – have seen positive shifts for homeowners where the numbers moved definitively from negative to positive, others have been a bit more oblique. While consumers’ household financial situations have strengthened, it was from a pretty low starting point. We are still in a situation where notably more people feel they are getting worse off month on month than are getting better off.'

Scott Corfe, Associate Director at the Centre for Economics and Business Research: 'Consumer confidence has dropped off a little. Although wages are increasing and there is zero inflation, for many the official facts and figures are still not being felt in their pockets. A significant share of households still believe that their living standards are declining. Consumers are also tuning into the fact that the future direction of the UK economy is on hold until after the election and until it is resolved their outlooks may well fluctuate.'

Find out more information about the Household Economic Activity Tracker

Image from PA