YouGov data – based on over 25,000 interviews – shows opportunities of augmented reality gaming for brands

Pokémon Go has been an overwhelming success in Britain, suggesting a bright future for mainstream augmented reality gaming from which both brands and developers can benefit, new data YouGov shows.

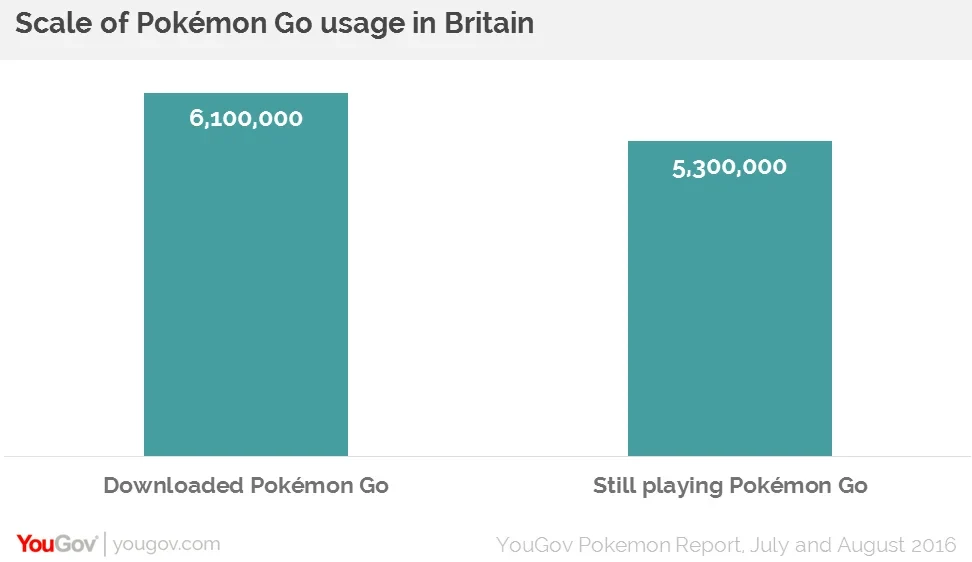

YouGov finds that 6.1 million adults (13% of the population) have downloaded and installed Pokémon Go since its UK release on 14 July. The data shows that 5.3 million people (87% of those who have installed the game) are still using the app, having played it within the previous week. This suggests that the first mass-market augmented reality game has staying power and is not just a flash in the pan.

Pokémon Go is a collaboration between The Pokémon Company and Niantic Labs, a developer who previously created the similar Augmented Reality game Ingress as part of Google. Players use a mobile device's GPS capability to locate, capture, battle, and train virtual creatures, called Pokémon. The game supports in-app purchases for additional in-game items.

Brand opportunities

Pokémon Go’s evident success with the public opens the door for brand tie-ups, both for this particular app and for augmented reality games in general. Some brands have already jumped on the Pokémon Go bandwagon, with McDonalds in Japan posting impressive second quarter sales figures after it turned restaurants into "PokéGyms" and "PokéStops" to lure in players of the game.

YouGov Profiles data highlights which brands British Pokémon Go players are customers of. It shows that these consumers present both retailers and food and drink manufacturers with significant brand tie-in opportunities.

Many players are customers of Kinder, suggesting the confectionary manufacturer could link Pokémon to the gift in the brand’s egg. Cinema chains also feature heavily in players’ top brands. Film promotions often feature clever marketing tie-ups and Pokémon offers the cinemas themselves the chance to boost their profiles and increase footfall through canny brand association.

Importantly when it comes to brand tie-ins, YouGov’s research shows that although the majority of Pokémon Go players are more likely to be young, the game is by no means limited to the under-35s. Although two in three of the app’s users (66%) are aged 18-34, fully a third (33%) are over 35 (although just 4% are 55+). As such brands should make sure they don’t just focus on young people but also on those moving into middle age.

Attitudes of players

From a marketing perspective, as important as what these consumers buy is what they think and how they act. YouGov Profiles data also shows the attitudes of people in Britain who have downloaded Pokémon Go.

Music is central to their lives. They are more likely than the rest of the population to consider themselves as ‘musical’ and they claim that they couldn’t get through the day without music. They tend to listen to it via streaming services but do not always source their songs legally – seeing nothing wrong with downloading music without paying for it.

The data shows they are more likely to favour newness when it comes to music or fashion and also veer towards vanity – liking to stand out and thinking it is important to look good. However, they are more likely to be unmotivated. While they are highly educated, on the whole they are more likely than the rest of the population to be unambitious, easily distracted, and classify themselves as under achievers.

While Pokémon Go has been talked about a lot since its launch, until now no one has understood much about either the scale of its use or what the app’s success means for this type of augmented reality app in the future. Our data makes it clear that not only have a lot of people downloaded the game and the vast majority are still playing it, but also that the brand opportunities for this particular game and similar games in the future are vast.

It is a mistake to think that this is just a fad for young people. A lot of players are over 35 and this represents a completely different marketing proposition to brands wanting to partner with this type of augmented reality app. Crucially the people playing this game can be easily bored meaning that developers will need to innovate and push out new features if they are to keep up interest levels.

Augmented reality’s commercial viability

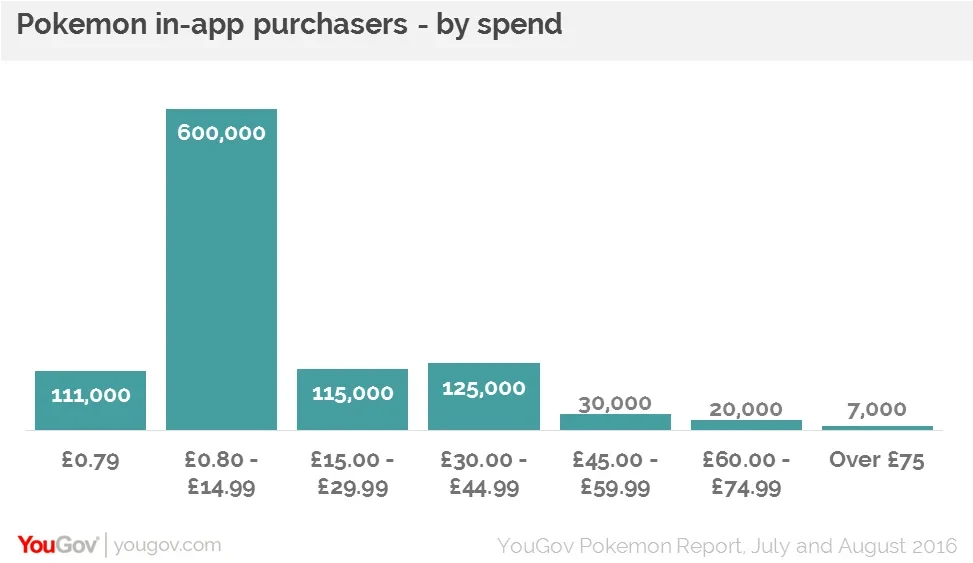

In a finding that points to the long-term commercial viability of such apps, YouGov’s report suggests that over one million British Pokémon Go users (16% of players) have spent money on in-app purchases since the game was launched. Of these, a slim minority of 111,000 have only made the smallest available payment of 79p (for the minimum purchase amount of 100 Pokécoins).

Most have paid more than the minimum. Around 600,000 have spent between 80p and £14.99 (the price of 2,500 Pokécoins), indicating they have either made multiple small purchases or slightly more substantial one-off purchases. Around a quarter of a million players have made larger investments of £15 or more on the game, with this group alone spending over £7m.

It is important to look beyond the clutter news stories about people marching into the sea to catch a Pokémon and instead look at what this game represents from a business perspective. Brands including the likes of Harry Potter and Game of Thrones must now be eyeing ways to make the most of the opportunities that augmented reality gaming offers. Not only does Pokémon Go show that consumers are prepared to make a giant leap and start making significant in-app purchases in an augmented reality app, but it can also help build an intense engagement with a brand.

Britain’s love affair with the game is not unique – nor is the country’s susceptibility to augmented reality apps. YouGov ran parallel research into Pokémon Go usage in the United States. It shows that 34.3 million people in America have downloaded the app since launch, 30.8 million have played it within the past week and over 10 million have made in-app purchases. The research suggested some slight variance in the age demographic of players, with the game being slightly more popular among younger people than in Britain.

About YouGov Profiles data

The full Pokémon Go/Augmented Reality report highlights the power of YouGov Profiles. Any new survey data can now be analysed by connecting it with 190,000 variables meaning that you no longer just have the results from the questions that you asked instead you can link it to everything that YouGov already knows about people across their entire lives.

As a result, YouGov can analyse those that have downloaded Pokémon Go and compare them to the one million plus people who are spending money on in-app purchases and also look at the other brands Pokémon Go players use. For example, we know that Pokémon Go users are also Kinder, Primark and Odeon customers.

This is important information but how does it look when we narrow things down to the most valuable customers – looking at what else are they watching doing? The full Pokémon Go/Augmented Reality report looks at this area and pulls out the most important differences across all 190,000 variables – from media consumption to brand interaction, to attitudes, to digital behaviour and more.

For more information phone 020 7012 6089 and find out how you can harness the power of connected data in YouGov Profiles.