Packaged bank accounts – which general incur a monthly subscription fee in exchange or a range of benefits – are increasingly for affluent, family men and less likely to be held by less affluent consumers, new research from YouGov finds.

The Packaged Bank Accounts 2015 report finds that one in five (20%) consumers own a packaged bank account in 2015, virtually unchanged on 2014 (when it was 21%). YouGov’s research shows that above average penetration occurs for adults in the AB social grade, the retired, those in full time employment and consumers who are married or in civil partnerships (all 24%).

Those less likely to have such accounts include women (18%), those in the D and E social groups (14% each) and those on lower incomes (just 11% of people earning £10,000-14,999 a year have a packaged bank account). Furthermore, divorced (15%), widowed (12%) and people who have never married (14%) are less likely to have one of the accounts, as are people who are unemployed or not working (both 10%).

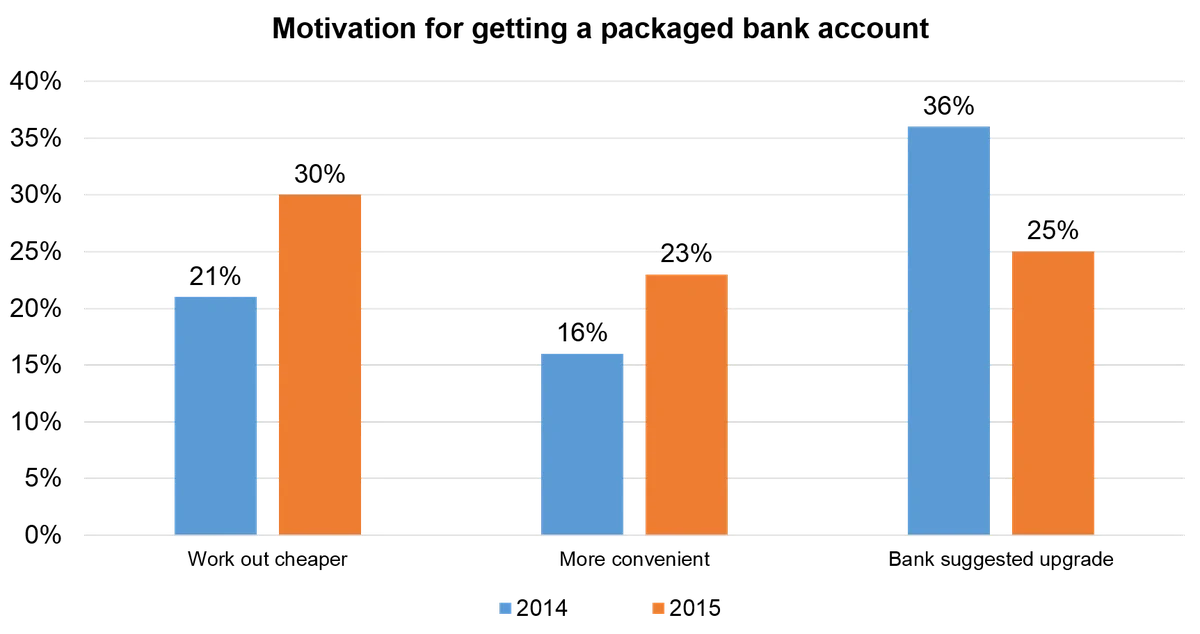

YouGov’s research suggests that packaged account holders’ motivations for having the accounts have altered in some notable ways over the past year. There has been an increase in those who say they work out cheaper in the long run (21% last year increasing to 30% this) and those who say they are more convenient (from 16% in 2014 to 23% in 2015).

However, the new regulations to help ensure consumers are not sold products inappropriate to their needs seem to be making an impact. There has been a sharp decline in the proportion of account holders who say they opened a packaged bank account because the bank suggested an upgrade (down from 36% last year to 25% this year).

James McCoy, Research Director of YouGov Reports, says: “The market is losing the custom of less affluent consumers who see less cost savings and less convenience from owning a packaged account and who, because of new regulations, are less likely to be sold products inappropriate for their needs. At the same time, the demand for accounts is changing, with new buyers less concerned with the bundled insurances and other benefits packaged into the account and more interested in taking out products that offer the payment of interest if accounts are in credit and offer cash back on spending.”

More information about YouGov Reports

Image from PA