Level of cover the top concern for those looking to change insurer

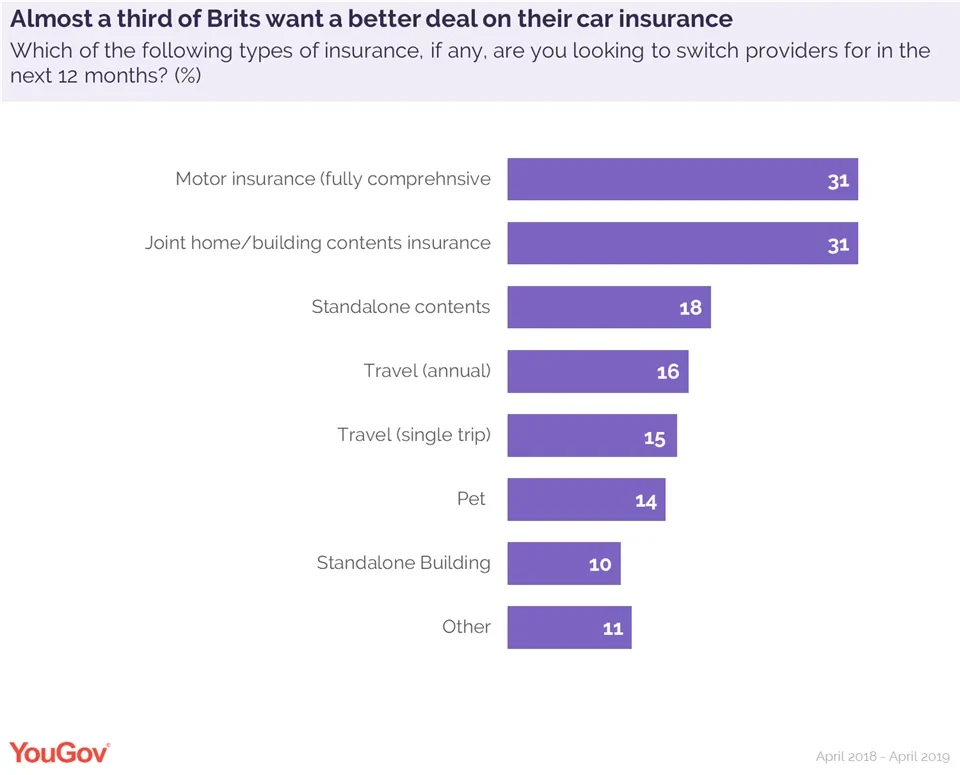

Do car insurers need to switch gears? YouGov’s recent whitepaper, Better safe than sorry, indicates that almost a third (31%) of Brits with comprehensive vehicle policies will be shopping around for new providers in the next year.

Following trends in the wider insurance market, where two out of five policyholders claim they’re “always” looking for a better deal, these findings reflect an industry where customers have a range of options at their disposal – and a clear willingness to explore them.

Driving change

It isn’t a simple race to the bottom. Cost matters to switchers – it’s the second most important factor – but the top consideration for insurance customers across all categories is cover. Rising premiums may be a stereotypical industry problem, but they only rank seventh in motorists’ priorities.

Rounding out the top three is confidence of payout, which reflects broader trust issues with the insurance industry: almost three quarters (73%) of Brits don’t trust their providers to pay out a legitimate claim. Recommendations come dead last, so providers shouldn’t rely on customers to spread the good word; based on these findings, policyholders won’t listen.

Some 45% of those looking to leave their provider are considering Direct Line, which is also the first choice for 11% of policyholders – more than any of its competitors. This may be a reflection of its higher ad awareness: 30% compared to Churchill’s 24% and Admiral’s 19%.

But while Direct Line is the single largest switching beneficiary, it’s a close competition: Admiral (43%), Churchill (42%), Aviva and Liverpool Victoria (41%) are also in the running.

Insurance innovations

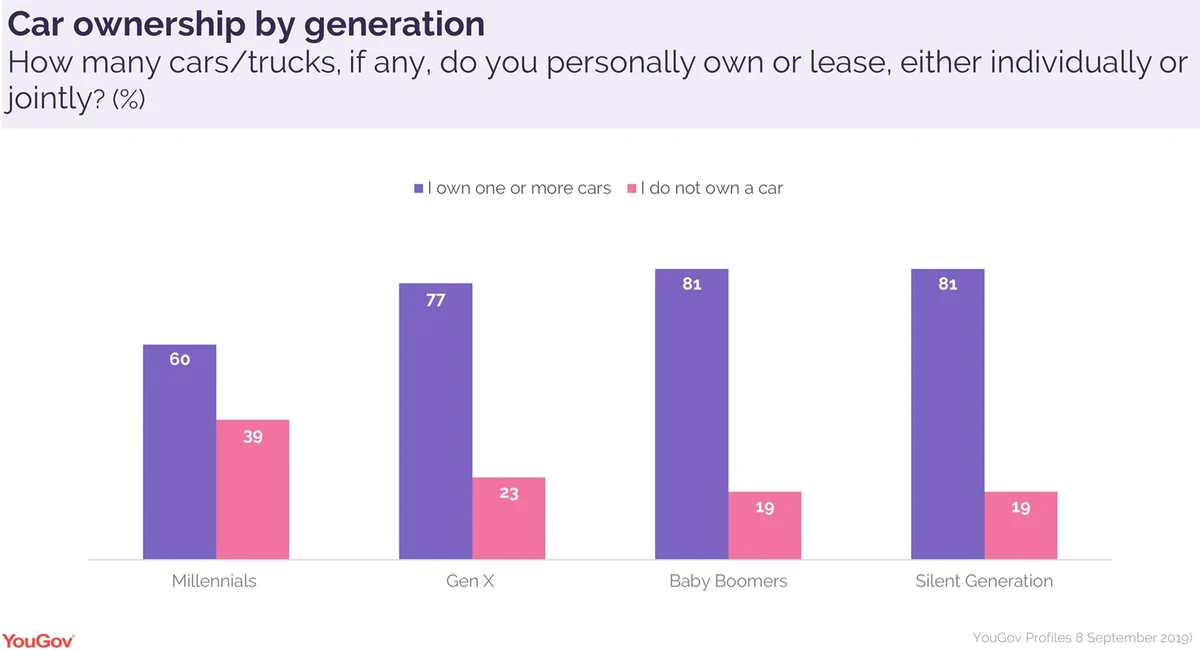

Beyond the competition, insurers should pay attention to demographics. While comprehensive motor insurance is the top priority across all generations, it’s more important to older cohorts: over three quarters of Baby Boomers have it (with the “Silent Generation” close behind) compared to fewer than half of British millennials. This may be because nearly two-fifths of Millennials don't own a car/truck (compared to 23% of Gen X and 19% of Baby Boomers and the Silent Generation).

If car insurance and ownership skew older, it may explain why there’s a relatively limited appetite for modernisation: the insurance dashcam is by far the most popular innovation among all policyholders, but only 15% actually want it. What’s more, only 6% want tools that are fairly easy to install and use such as smartphone driving apps.

For the moment, then, motor insurers may want to focus less on technological bells and whistles and more on the factors that motivate a switch: cover, cost, and confidence of payout. How they face a future where fewer people have cars and fewer people need car insurance is a little less obvious.

Image: Getty

Download the full whitepaper