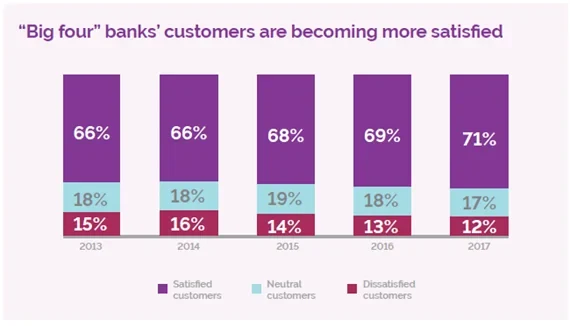

YouGov research published in its ‘Shape of Retail Banking 2018’ report indicates that the ‘big four’ banks have improved their customer satisfaction scores over the past five years.

YouGov BrandIndex data shows that taken together, the ‘big four’ banks – namely Barclays, HSBC, Lloyds and NatWest – have seen their Satisfaction scores (whether someone would say they were a satisfied customer of a brand) rise incrementally since 2013.

In 2013, the average satisfaction score across the four banks was 66%, this rose to 68% in 2015, before jumping to 71% in 2017. Similarly, while 15% were dissatisfied in 2013 that number decreased to 12% in 2017.

Barclays has shown the greatest improvement of the four. Its individual score has grown by 7% since 2013, from 62% to 69%.

Satisfaction by age

Younger people (18-24 year olds) are most likely to be satisfied with their ‘big four’ bank. Our study shows that men in this age group have a satisfaction rating of 76%, while among women this figure is 83%.

However, only 69% of men aged 55+ are satisfied with their bank, while 73% of women in the same aged bracket are. The big four banks have the lowest satisfaction rating among males aged 35-44 (64%).

Our study is encouraging for the ‘big four’ banks. After several years of adverse press and a certain amount of controversy, it looks as though the bank’s hard work to re-connect with customers is paying off.

There are several reasons why younger people are more satisfied with their bank. Obviously, they’re less likely to have complex financial needs such as a mortgage, and are also less likely to have been affected by the financial crisis of ten years ago. The challenge for banks is to continue to cultivate their relationship with these customers in a positive way.

However, while the situation is improving, the ‘big four’ still have work to do to catch up with building societies such as Nationwide, and other challenger brands.

Image Getty