Consumption of meat and dairy alternatives such as Quorn and plant-based milk is growing, even among people who are not exclusively vegan or vegetarian.

The number of vegans and vegetarians has been rising steadily over the years, representing a growing opportunity for food manufacturers. But also rising, and possibly benefiting these companies, is flexitarianism, where people reduce the amount of meat they eat rather than totally avoiding it.

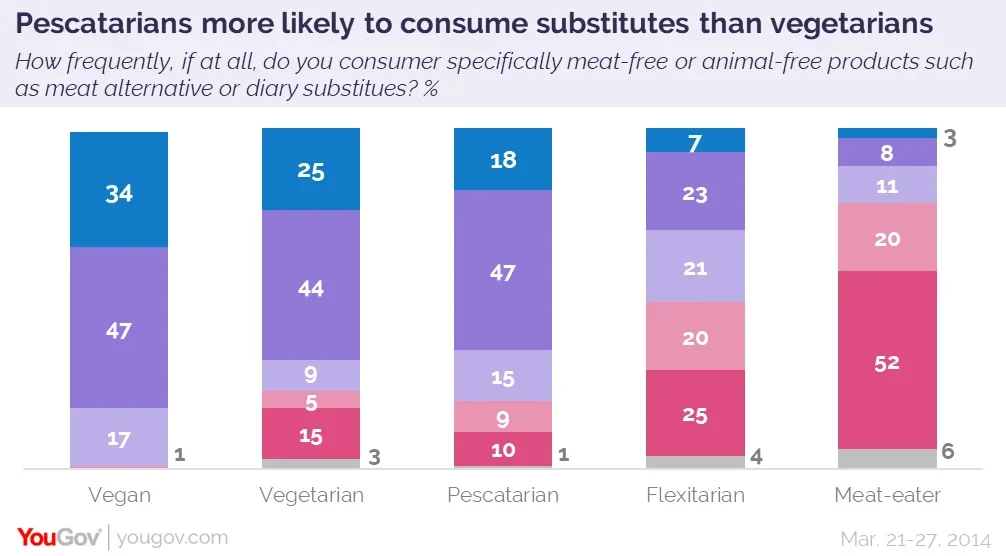

Our research shows that even carnivores eat meat or dairy substitutes a least once a month (22%), which rises to more than half of flexitarians (51%) and 80% of pescatarians.

The data suggests that brands have a great opportunity to increase their market share among flexitarians: under a third (30%) use a meat or dairy substitute at least weekly. But how big is the potential market for meat substitute brands?

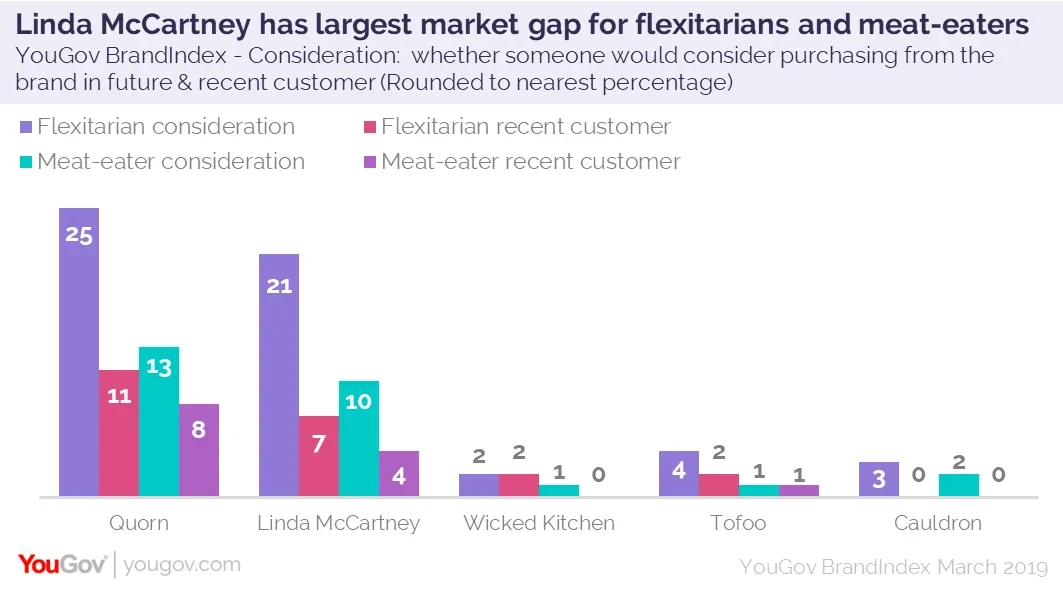

Taking five large substitute brands; Quorn, Linda McCartney, Wicked Kitchen, Tofoo and Cauldron, the market opportunity is calculated by comparing the Consideration scores (whether someone would consider purchasing from the brand in future) with those who are a recent customer of the brands.

YouGov data shows that Linda McCartney had the largest gap in the market for both flexitarians (14% - c.975,000 people) and meat-eaters (6% - c.2.3m people). This shows that although the overall percentages are larger for flexitarians, the potential growth in market size among meat-eaters is greater.

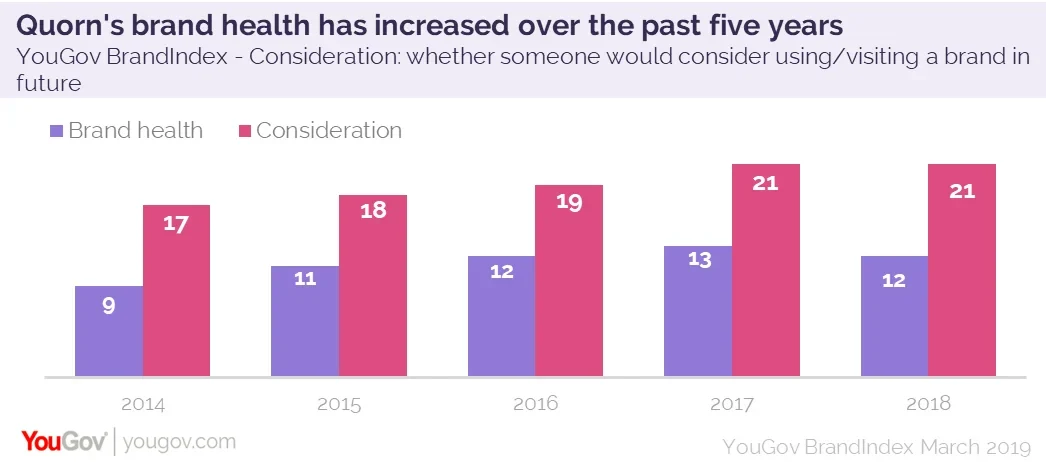

Quorn was one of the first brands to offer vegetarian versions of traditionally meat-based dishes, launching its mycoprotein-based products in the mid-1980s. It still has the largest share of the market, and as a result of this their brand health and consideration scores have risen in recent years and remain steady.

Our research implies that the number of vegetarians, vegans and flexitarians is rising alongside the number of meat-eaters who consume substitute products. If brands can highlight the market share among flexitarians available to them then they’re sure to profit from consumer’s changing eating habits.

Image: Getty

Click here to read more and download our whitepaper on Is the Future of Food Flexitarian?