The launch of Atom bank earlier this year was a watershed for both the finance and technology sectors

It is the first British bank with no branches and no call centres as everything is done through an app on customers’ phones.

Around 30,000 people have signed up for Atom so far. While these numbers by themselves may not have the high street behemoths quaking in their boots, what Atom represents is a massive shake-up to the financial sector. But should traditional retail banks be concerned?

YouGov’s new Apps in banking report finds that over four in ten (45%) adult Britons now use a banking app. Furthermore, online banking is in the top ten app activities, along with the likes of social networking and streaming media.

Naturally, young people are at the vanguard of this move to digital finance. Over one in eight (14%) under-35s think traditional banking is a thing of the past and are also less inclined than older consumers to enjoy the security of going into a branch.

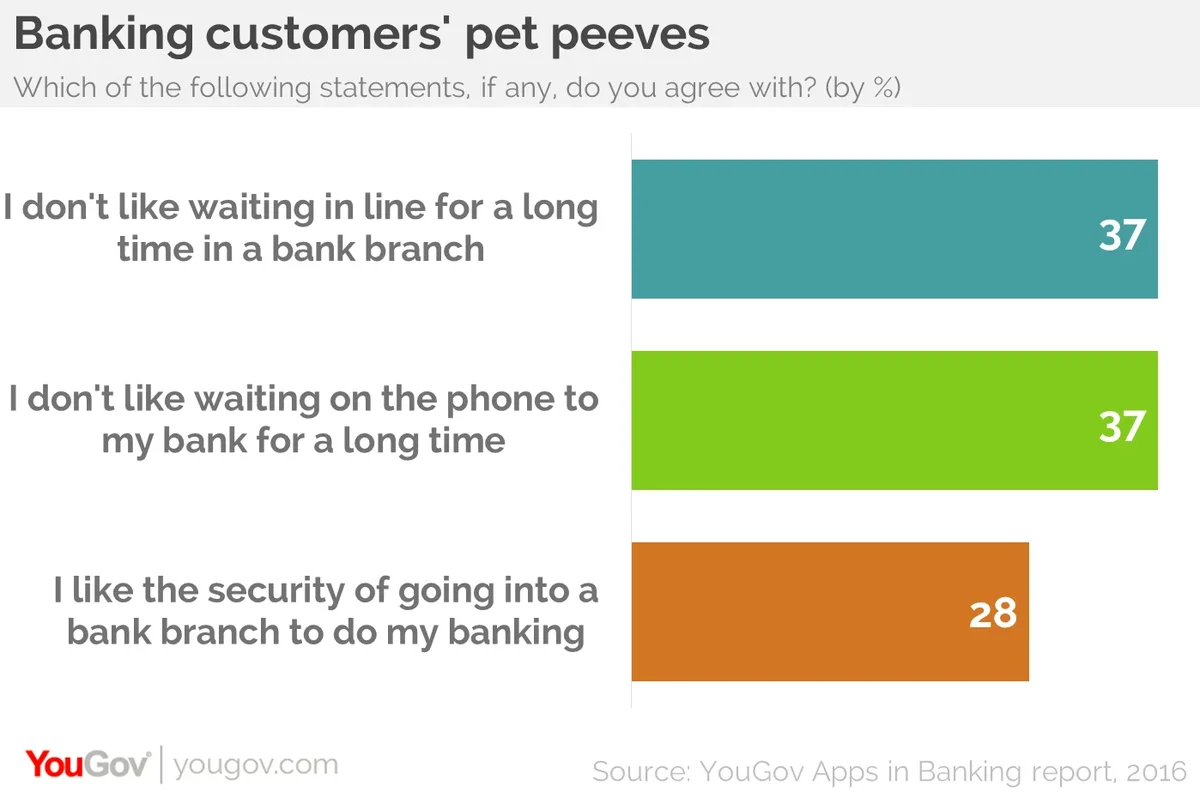

Furthermore, our research shows that, in the age of one-click retail, customers of high street banks are growing frustrated with the traditional way of doing things. Nearly four in ten don’t like waiting for a long time on the phone to their bank (37%) or in line in a branch (also 37%). This impatience is even more pronounced amongst younger generations.

However, despite the benefits of digital finance, hardly anyone would want it as their sole form of banking. Almost nine in ten (87%) consumers wouldn’t put all of their money into an app-only banking provider.

As we see with a lot of technology, what starts with young people and early adopters soon becomes the norm. While high street retail banks are making big strides to meet current customer needs, the appetite of consumers to do more from their phones won’t go away.

It is in banks’ interest to clear the path on this instead of following the crowd – as Atom’s products are unlikely to provide the last app-only challenge.

Find out more about YouGov Reports

Image from PA