The coronavirus outbreak has made 44% of Brits feel less financially secure – but a small minority have seen their savings increase and debts go down

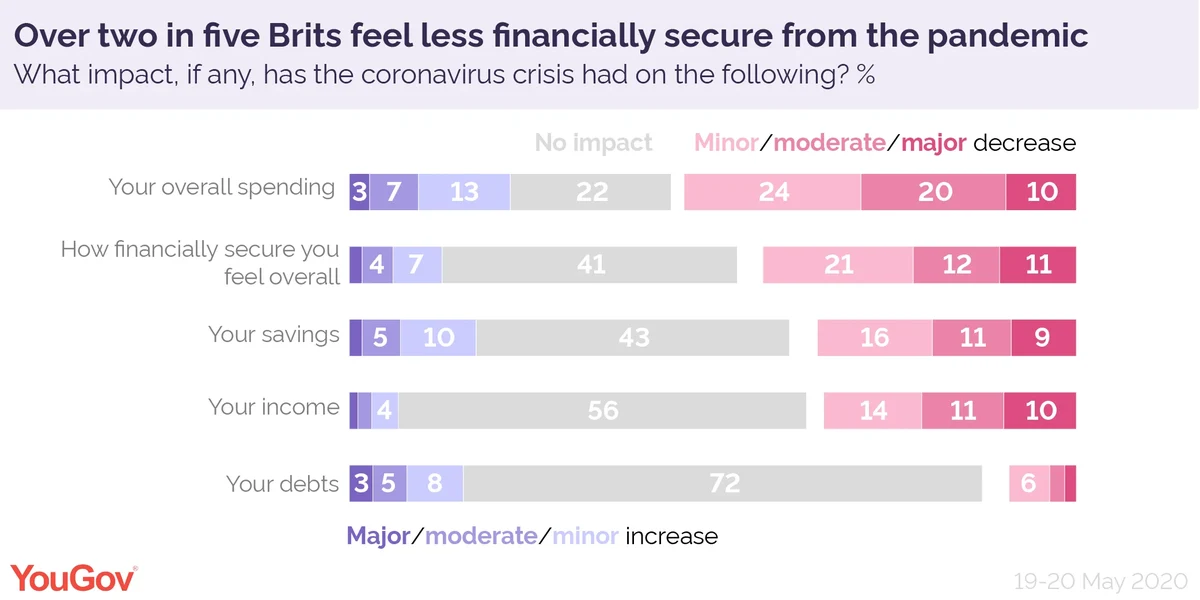

The impact of the coronavirus outbreak on many Britons’ finances is bleak: 44% feel less financially secure, over a third say their savings have taken a hit (36%) and a similar number (35%) say their income has gone down. Meanwhile, 16% say their debts have gone up.

Brits aged 25 to 34 are the most likely to say their income has gone down overall (43%). But the proportion of people who say the pandemic has caused a major decrease is highest among 55 to 64-year-olds (14%).

Overall spending has also dropped sharply with over half (54%) having spent less money because of the coronavirus outbreak. This includes one in ten who say they’re spending a lot less. In contrast, about a quarter (23%) say they’ve been spending more.

Some Brits say their finances have improved from being in lockdown

A small minority report that the pandemic has improved their financial situation. One in six (17%) have put more money in savings than they otherwise would. This figure is highest among younger people at 30% for 18- to 24-year-olds and 26% for 25- to 34-year-olds.

People in the ABC1 social group, which includes professionals, are more likely to have increased their savings (20%) than C2DEs, who predominantly work in manual occupations (14%).

One in ten Brits say the coronavirus outbreak has enabled them to pay off debts. This is most common among people aged 35 to 44 (14%), while there’s little difference between ABC1s (10%) and C2DE1s (8%).

Younger people aged 18 to 24 are the most likely to say they feel more financially secure than before the pandemic at 18% compared with the national average of 13%. The figure is lowest among 54- to 65-year-olds (9%).