As Christmas approaches, the debt gap on credit cards between people who are over-indebted and those who are not has widened, new data from YouGov shows.

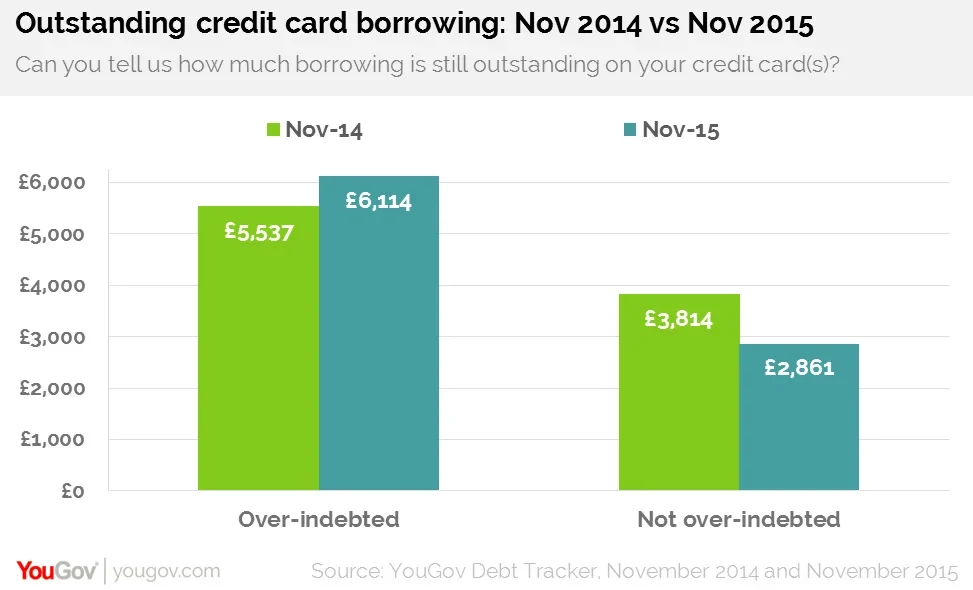

Fresh data from the Debt Tracker study shows that over-indebted people are carrying over more debt each month. These are people who have identified their financial situation as a ‘heavy burden’, or have found themselves struggling to keep up with credit commitments on a consistent basis. YouGov’s research shows that they are going into the festive period with an average of £6,114 on their cards, an increase of £577 on this time last year. Meanwhile, credit card holders who are not over-indebted have seen an average year-on-year fall of £953 on the amount of borrowing they are carrying on their cards.

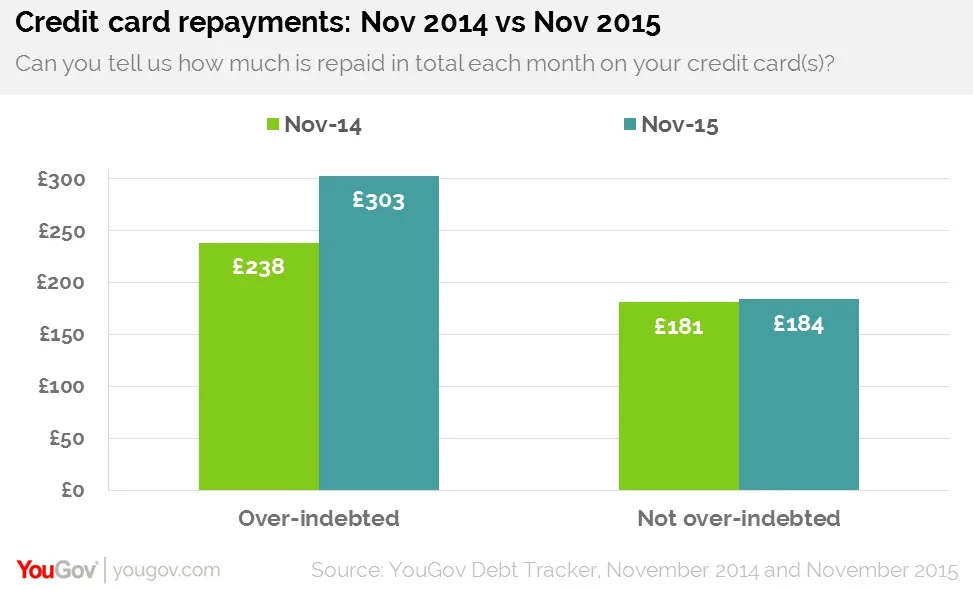

The research finds that consequently, those under the greatest financial pressure have had to greatly increase the amount of credit card debt they repay each month. In November, over indebted consumers repaid an average of £303 in November, £65 more than their repayments at this time last year. However, the level of repayments made by those in more stable financial situations has remained steady– paying an average of £184 in November, just £3 more than this time last year.

YouGov’s quarterly Debt Tracker examines consumer indebtedness and borrowing behaviour and gives a comprehensive account of all forms of debt. It finds that people who are over-indebted are much more likely to be working part time or living on benefits such as unemployment or disability allowances, have a low household income and more often than not find themselves short of money and struggling to last out to the next payday.

The latest research shows that as the festive season approaches a great many people are finding it difficult to pay off their credit card debt. Just under half (47%) of card holders in the Britain always pay off the whole amount they have on their credit card each month and 14% ‘usually’ pay off the amount outstanding. However three in ten (30%) pay off as much as they can afford and just under one in ten (8%) pay the minimum amount.

Leo Brownstein, Research Manager at YouGov who runs the study, says: "The past year has seen wages rise and the economy grow. While this is true for many people, for others the situation is different and the past ten years has left a scar of debt which is still growing. This debt gap is widening with those faced with shrinking levels of benefits and on low household incomes becoming increasingly stranded on one side. The greater credit card debt brings higher monthly repayments which in turn means less available money for everyday living expenses. The chances are that this situation will only get worse in the year ahead."

Find out more about Debt Tracker

Further information about YouGov's Financial Services research

Image from PA