More Conservatives than not say the poll tax was a good policy – but the most popular system of council funding is now a tax based on people’s income

25 years ago today around 200,000 people descended on Trafalgar Square to protest the Poll Tax – Margaret Thatcher’s council levy, known officially as the Community Charge, which replaced a tax on the value of houses with a tax that would be the same for everyone. The riots were the worst for a century, with 113 injuries and 340 arrests, and by the end of the year Mrs Thatcher had been forced to step down. Her replacement, John Major, scrapped the poll tax. His system of council tax is still in force today.

To mark the anniversary YouGov has asked British people if they would support replacing the current system, based on the value of properties, with a flat rate of tax charged to each individual person, without calling this a ‘poll tax’. The idea is opposed, but not greatly (46% are opposed and 31% are in support). Conservatives tend to support the idea, by 44-39%.

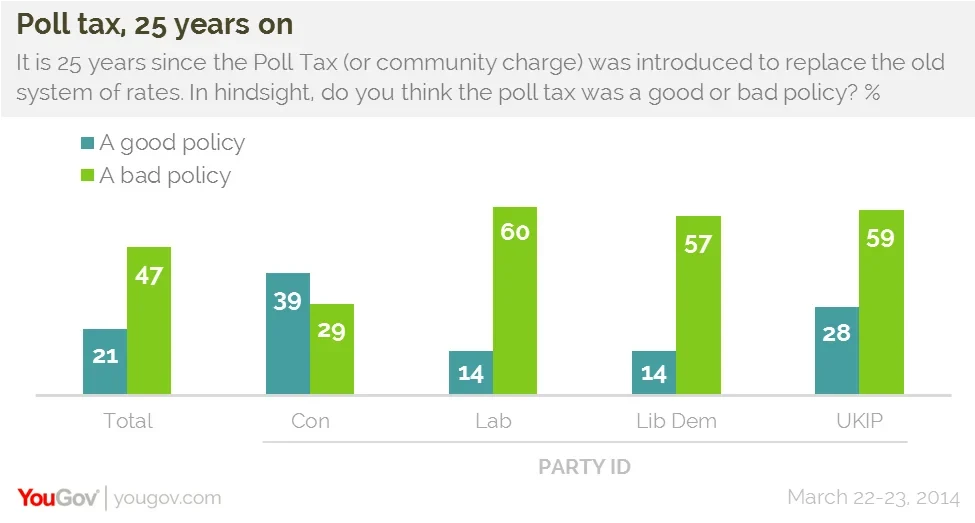

The historical introduction of the poll tax is far less popular, however. Although more people see non-payment of the tax at the time as wrong rather than right (44-33%), 47% say that in hindsight it was a bad policy and only 21% say it was a good policy. Conservatives tend to defend the policy by 39-29%.

The likely reason for the discrepancy – more people supporting a new poll tax than calling the poll tax of 1990 a good idea – is that memories of the riots are still fresh. Another reason might be that the current system tends slightly to be seen as unfair (by 44-40%), giving alternatives greater salience.

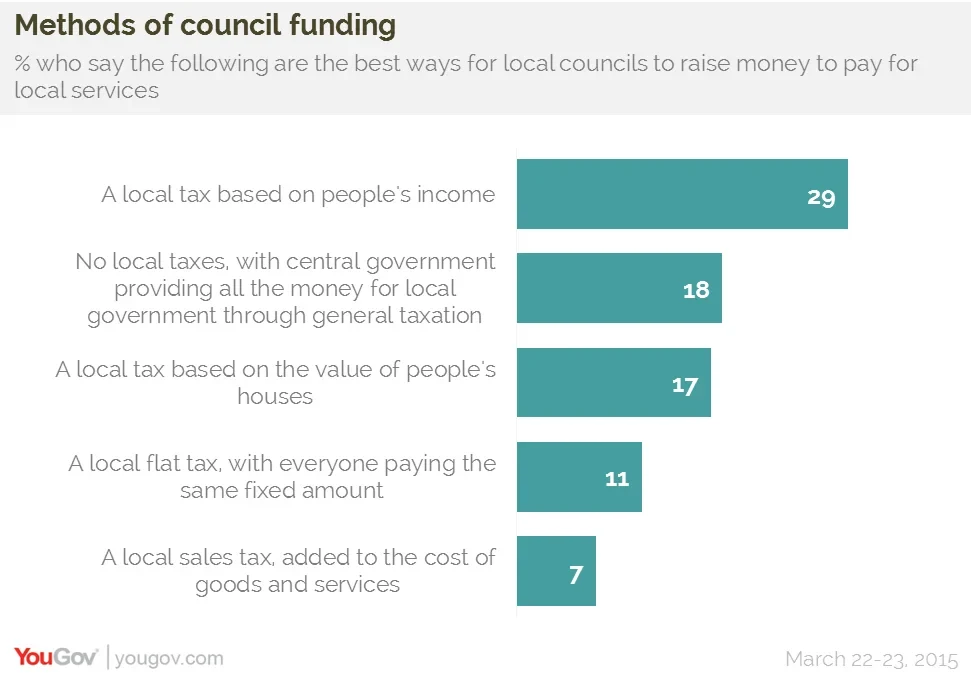

Council tax has been criticised for being based on out-dated bands, still tied to the value of homes in 1991 when the price-range was narrower. When given a number of options, British people say that a local tax based on people’s income would be the best method of council funding (chosen by 29% compared to only 17% who choose a tax based on the value of houses).

At present owners of any house that was worth over £320,000 in 1991 pay the top rate of council tax, but this includes anything from a fairly modest flat in an expensive part of the country to a multi-million pound mansion. Many argue that reforming the council tax system, partly by dividing the top rate into higher bands, would be a more progressive method for raising revenue. When YouGov asked people in London (where Labour are leading in the polls) which would be a better way of collecting tax on expensive homes, they chose council tax reform over Labour's mansion tax by 48-31%.