While Sales Days and Christmas seem far in the future, how can retailers start preparing now?

Recent YouGov custom research indicates that sales day events such as Black Friday and Cyber Monday saw a slowdown in engagement in 2017. For the first time since 2014, when we began tracking this data, awareness of Black Friday has seen a significant year-on-year drop.

This fall in awareness matches the decrease in Black Friday purchases over the past four years. While 20% of people said they had bought something online for themselves in 2016 and 19% had bought something as a gift, this fell to 18% and 17% respectively in 2017.

The excitement over sales days seems to have fallen too. While one in five (20%) people state that they look for sales day bargains as part of their Christmas shopping, this figure has not changed since 2016. In fact, over two thirds (68%) of those who shopped during sales days in 2016 said they did so either at the same level – or even less – last time around.

But what can retailers do to halt this downward trend and what do they need to consider to make the most of sales days in 2018?

1. Engaging young people better

The data indicates that 18-24s could be the key to the growth of sales days.

This cohort has lower levels of disposable income so budgeting is critical to younger age groups and consequently sales are arguably more important for their Christmas shopping activities. Almost half (49%) said that discounts help with their Christmas shopping, compared with 25% of the general public.

In addition, twice the proportion of 18-24s say they intend to use sales days to do the bulk of their Christmas shopping this year when compared with the general population (20% versus 10%).

However, this younger age group is much less likely to even be aware of sales days. When people were asked through which advertising channels they recall seeing a Black Friday advert, the top three were TV ads (70%), online advertising (51%), and email newsletters (45%). Of these three, 18-24 year olds had the lowest recall for two of them —TV ads (53%) and email newsletters (42%). This indicates that retailers are perhaps not maximising the right channels to engage younger people. So where can these younger people be engaged?

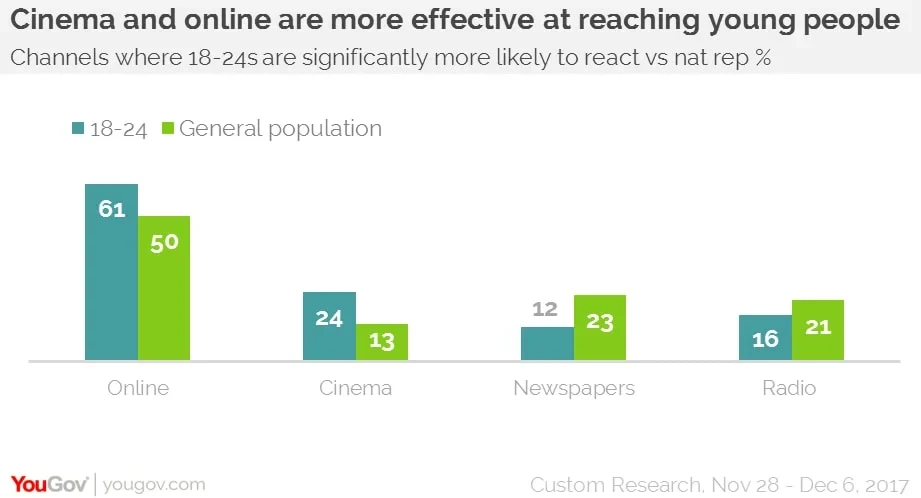

They are more likely than the general population to be online (61% vs 50%), and they are also more likely to go to the cinema (24% vs 13%). On the flip side, they are much less likely to read newspapers (12% vs 23%) or listen to the radio (16% vs 21%).

A quarter of this age group say their biggest source of news is social media, compared with 13% of the general population so this could be an effective way of reaching them. They are also more likely to use a news app on a mobile device compared with nat rep (19% versus 13%).

They are significantly less likely to say they get their news from television. Just 13% cite this as their main source of news compared with over a third (34%) of the public.

2. More efficient delivery methods

The data shows that almost half of those interacting with sales days in 2017 encountered issues with availability of items (28%), long delivery times (16%), or technical issues (10%). Of these problems, inefficient delivery had the biggest year-on-year increase (five percentage points).

With this in mind, could emphasising the benefits of Click & Collect be a good opportunity for retailers to encourage shoppers to take advantage of sales day deals?

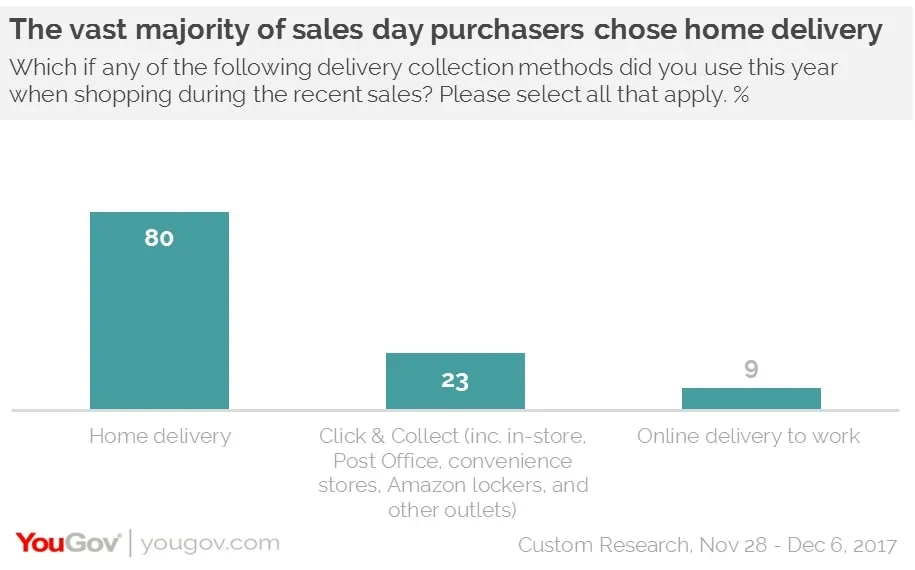

The service matches what consumers want from sales days when it comes to being easy-to-use and cheap. However, our data shows that in 2017 just over one in five (23%) shoppers used this option compared with 80% of people who went for home delivery.

Slightly more than half (51%) of those who have used Click & Collect did so to avoid delivery charges, and about the same proportion (50%) liked not having to worry about being away from home at the time the delivery arrived. What’s more, around two thirds (64%) of those who have used Click & Collect in the past six months said they had suffered no issues with the service.

To increase usage among the wider population, our research suggests that retailers should focus on “budgeting” and “ease-of-use”. Click & Collect is a delivery channel which realises both of these attributes. But with 80% of shoppers getting items delivered to their home, it seems that many consumers are not aware of this option and its benefits.

YouGov’s custom research team has been tracking sales day research since 2014. Whether your brand’s big sales day is Christmas, Black Friday or back-to-school, get in touch to find out how our custom team can help you make informed decisions and start planning now.