The proportion of Brits keeping up with their household bills is on the rise – but a substantial number of parents and those who rent their home still struggle to make it from one payday to the next

One in seven Britons (15%) are in financial distress, according to YouGov’s latest Debt Tracker. This is lower than it’s been in most quarters since the start of data collection in June 2010, but certain demographics, including parents and those renting their home, continue to struggle to make ends meet.

Someone is classed as being in financial distress if they are just about keeping up with bills, but finding it a constant struggle, all the way to being in real financial trouble and falling behind on debt payments and bills.

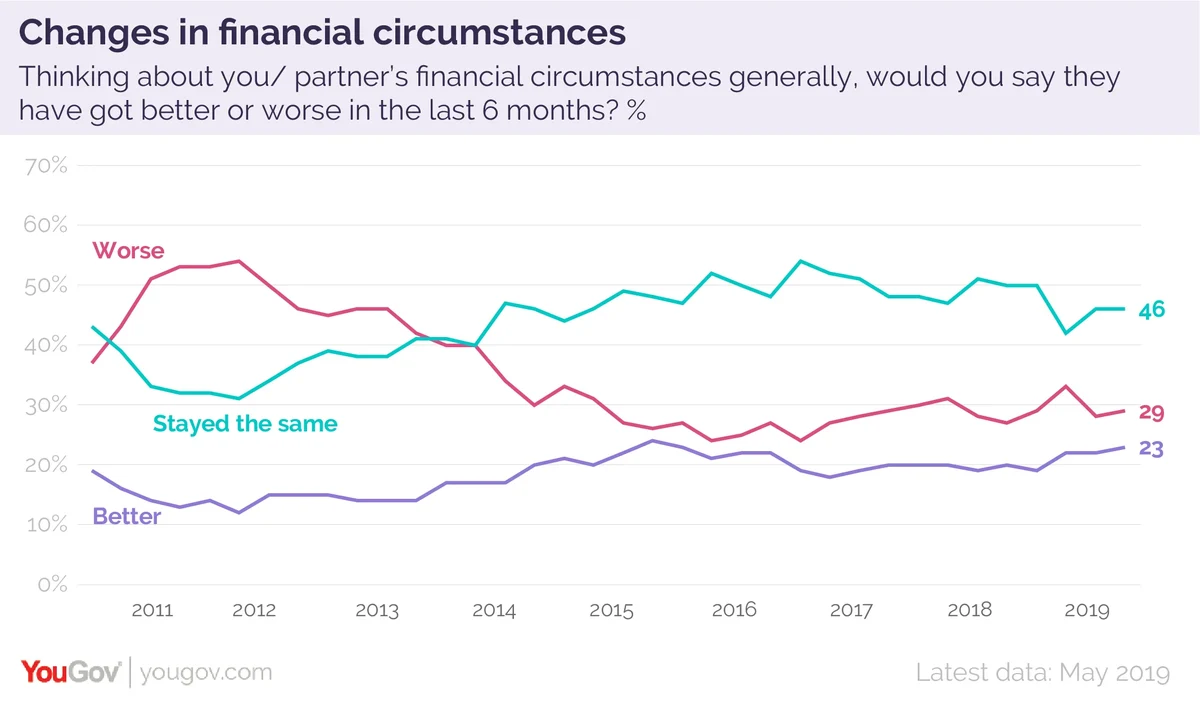

The proportion of Britons who say their financial circumstances have worsened in the last six months has fallen fairly consistently since a peak of 54% in 2011. It reached its lowest point of 24% in 2015 and has since risen slightly to 29% in May 2019.

A quarter of Britons (23%) say their financial circumstances have improved in the past six months, while half (46%) say they’ve stayed the same.

Who’s in financial distress?

Our data reveals that those in financial distress are on average 45 years old, and slightly more likely to be female (56%) than male (44%).

Four in ten (44%) are currently employed, and they estimate their gross household income to be just under £24,000 on average - compared to the UK-wide average of £38,000.

They are considerably more likely than average to be renting their homes (54% versus 31% in the general population) than owning outright (9% versus 29% in the general population).

Where one in four (27%) of the UK population as a whole are parents or guardians, four in ten (42%) of financially distressed Britons are. Just under a third (29%) are single parents.

Rising prices are the prime cause of worsening financial circumstances

People who say their circumstances have worsened in the past six months are most likely to blame an increase in household bills (51%), food costs (51%), utilities (47%) or rising prices generally (43%).

This proportion of people concerned about such costs dropped from a high of between 52% and 62% in early 2014 to around 35% to 40% in 2015-2016, but rose back up in 2017 and early 2018. However, data from mid-2018 to now shows the beginnings of another decrease.

A third (32%) say no increase in income, wages, pensions or benefits has affected their financial circumstances.

People in financial distress more likely to describe themselves as ‘impulsive’

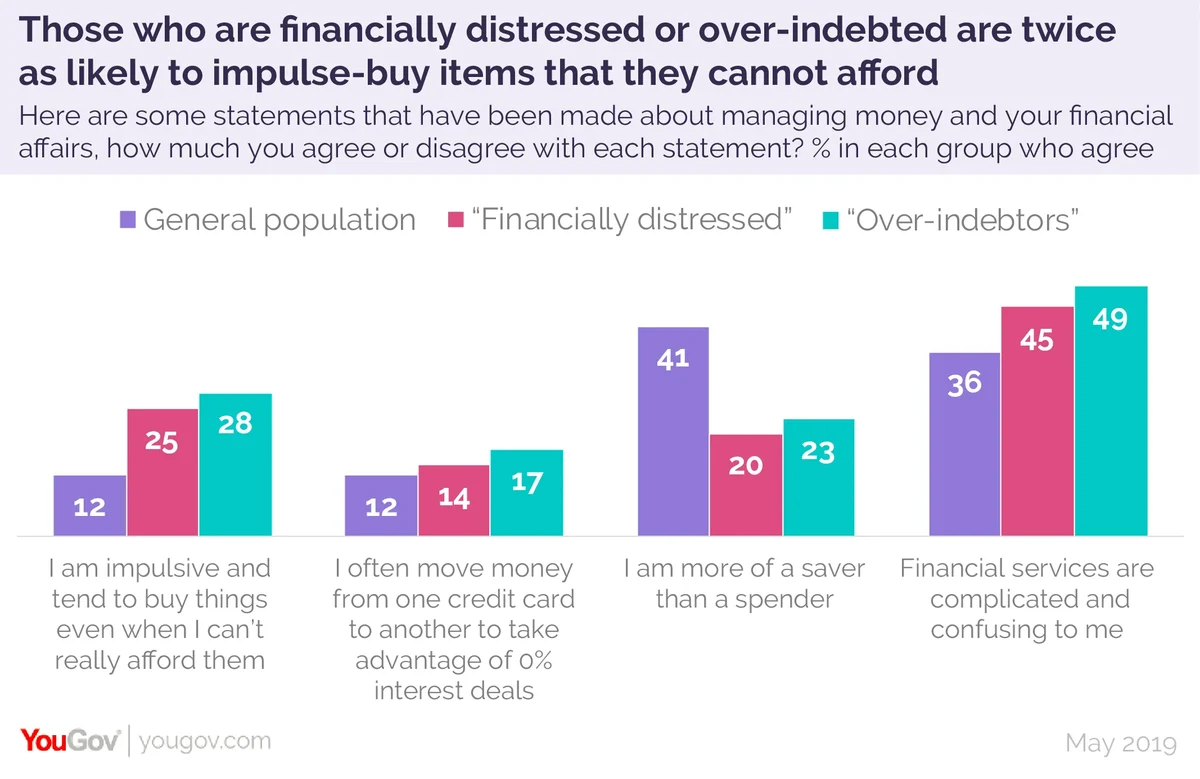

People who are in financial distress are twice as likely as the general public to describe their purchasing habits as ‘impulsive’, buying things they can’t really afford (25% versus 12% of the general population).

They are half as likely to describe themselves as more of a saver than a spender (20% versus 41% of Britons as a whole), or to read personal finance pages in the press (11% versus 20%).

Among the general public 43% feel that buying things on a credit card and paying it back each month is a smart way to manage money, and 28% do not, this is reversed among those who are financially distressed: 28% think it’s a smart move, but 42% do not.

Photo: Getty