With news emerging over the weekend of the proposed “exclusivity agreement” between Nisa, the corner shop group, and Sainsbury’s, it’s a good time to assess the fortunes of both brands and consider why such an agreement is being talked about at this time.

The arrangement to buy Nisa is said to be worth close to £130m, with Sainsbury’s reportedly having beaten rivals such as the Co-op in advancing the deal. Any agreement between the two brands would still need to be put to Nisa’s 1,400 members, with over half needing to approve it.

Convenience stores like Nisa and Spar have been squeezed in recent years. They are under pressure from budget brands such as Poundland, while the supermarket giants have focussed much more on smaller stores in order to adapt to changing consumer behaviour, for example, shopping little and often and dispensing with the traditional ‘big shop’.

Our research backs this up with 37% of Sainsbury’s customers going to the supermarket two or three times a week, while 15% go four times or more.

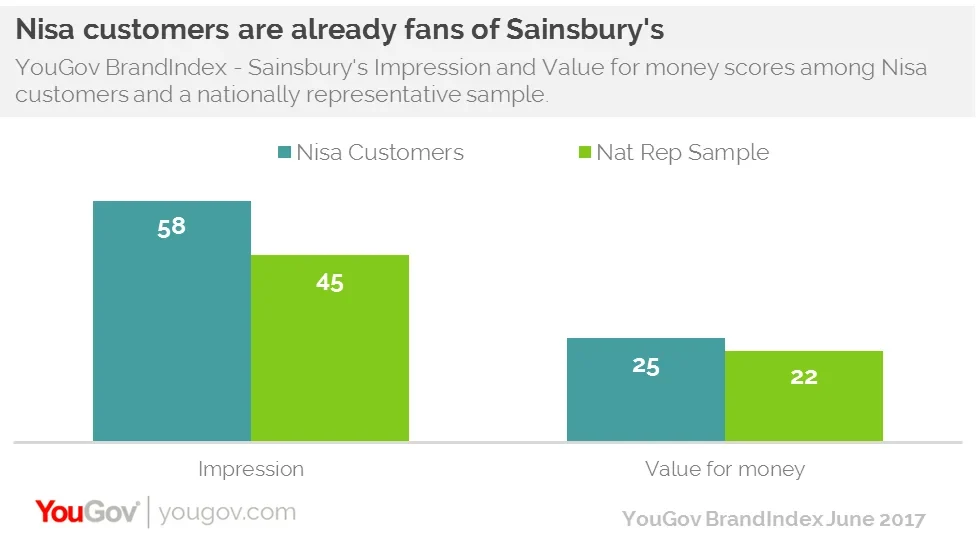

From a simple consumer perspective, YouGov Profiles data underlines one reason why an exclusivity deal makes sense and wouldn’t compromise brand loyalty. Our figures show that 46% of Nisa customers also shop regularly at Sainsbury’s, while 58% have a positive impression of the supermarket (compared to 45% of the public overall).

The hope will be that an association with the Sainsbury’s brand will increase business and indeed create wider awareness of Nisa itself. Looking at the brand’s Impression score among all respondents, it currently stands at -6, which puts it in the same ballpark as rivals Costcutter (-5) and Londis (-5).

Over the past couple of years Sainsbury’s has been ambitious. It has attempted to both regain the ground it had lost to budget supermarkets Aldi and Lidl and been trying to keep pace with a resurgent Tesco following news of its plan to purchase Booker earlier in the year. Sainsbury’s deal with Argos is another recent example of its ambitions.

Currently, among supermarkets Sainsbury’s sits in second place in terms of Impression score (+41), just behind Marks and Spencer (+45). The brand is well thought of, it isn’t standing still, and is reacting proactively to the shifting industry landscape.

Image PA

This article originally appeared in City A.M.