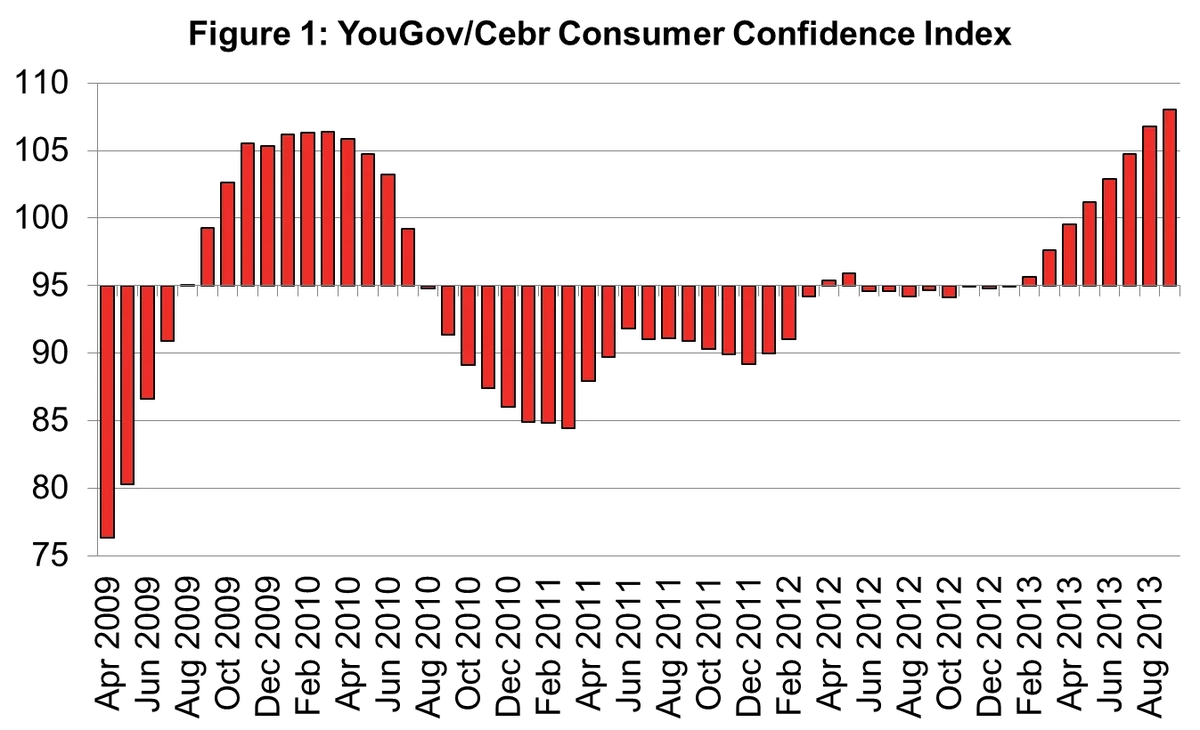

The YouGov/Cebr Consumer Confidence Index shows economic optimism is increasingly driven by stronger job security and workplace activity

YouGov/Cebr’s Consumer Confidence Index for September shows that the economic optimism of UK households continues to strengthen, rising for the ninth month in succession. This continued improvement in consumer confidence points to a further acceleration in UK economic growth during the third quarter.

This month’s headline figure shows the Consumer Confidence Index reaching 108.1, up from 106.7 in August 2013 and a massive 13 points from September last year when it stood at 94.6.

Source: Based on YouGov/Cebr HEAT data, September 2013

Notes: Axis value of 95 represents the average YouGov/Cebr Consumer Confidence measure since the data set began in 2009

The latest Household Economic Activity Tracker (HEAT) data from YouGov/Cebr show that consumer confidence is now higher than the initial bounce back from deep recession in 2010 when the Consumer Confidence Index peaked at 106.3. We now know that was a false dawn but the evidence from the figures suggests the UK is finally in a sustained recovery. Crucially, rising confidence is not just supported by rising house prices but is increasingly based on strengthening economic fundamentals.

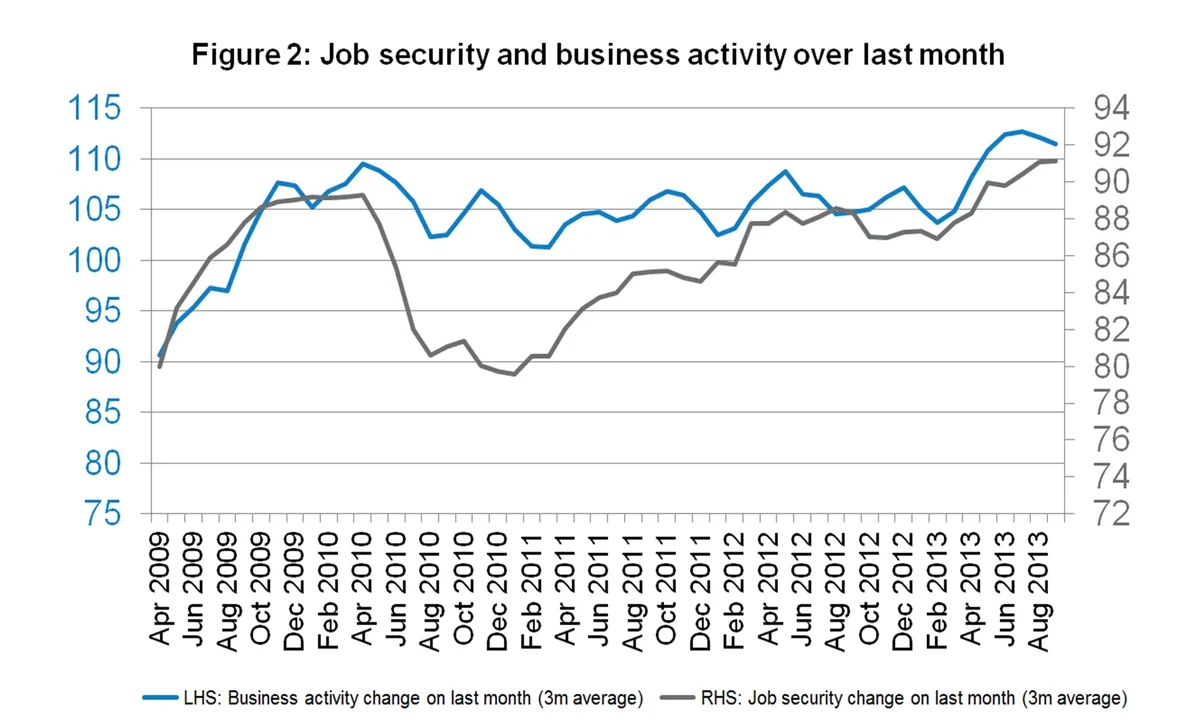

The Consumer Confidence Index’s Job Security measure has grown steadily in recent months, standing 2.4% higher in the three months to September 2013 than the same period last year and at its highest level since the survey began: the job security index stands at 91.1 compared to a previous peak of 89.3 in April 2010 and a long run average score of 85.9.

In addition, the Business Activity at the Workplace indicator has also strengthened, this month’s figures an improvement of 7.1% compared to September 2012. The Business Activity index stands at 111.4 in September 2013; the highest on record and stronger than the previous 109.5 peak in April 2010.

Source: Based on YouGov/Cebr HEAT data, September 2013

Stephen Harmston of YouGov: “Although a lot of the talk about the rise in consumer confidence has focused on the house price bubble, these figures suggest it is now also underpinned by a strengthening of the economic fundamentals. In the past six months, the year-on-year improvements in in both job security and business activity have been pronounced and steady. While they may not as breath-taking as the surge in property values, they do point to a recovery that is based on more solid foundations. This is an increasingly robust recovery.”

These latest results provide further indication of the strengthening UK recovery. The YouGov/Cebr Consumer Confidence Index correctly anticipated the acceleration in growth seen in the second quarter of 2013 and points to a further pick-up in Q3 2013. The latest Office for National Statistics estimate is that the UK economy expanded by 0.7% quarter on quarter in Q2 2013 up from 0.3% in the first quarter. Cebr expects at least a 0.8% quarterly expansion in Q3 and the YouGov/Cebr data supports this view.

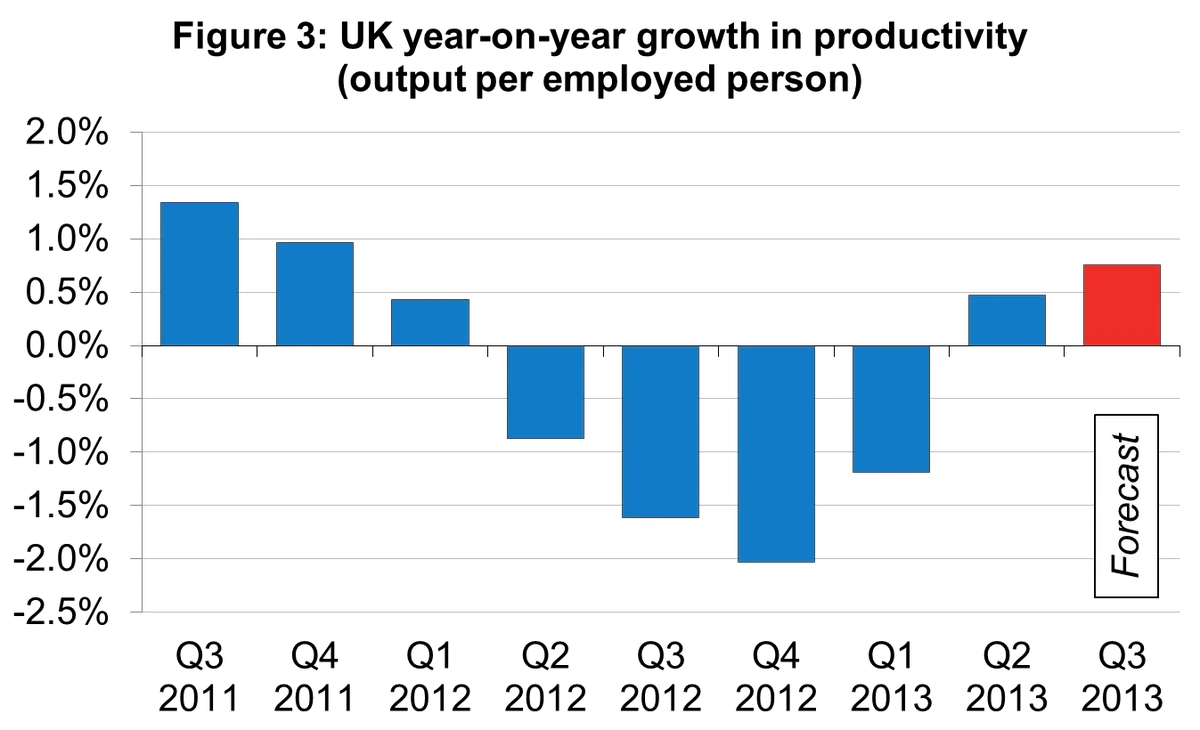

The upturn comes alongside a slowdown in employment growth following surprisingly strong job creation in 2012. Employment increased year-on-year by a high of 2.1% in the three months to December 2012 but this rate has been falling ever since to reach just 0.9% in the three months to July 2013 and is expected to stand at 0.8% year on year in Q3 2013.

With output increasing but job creation slowing, the upshot is a return to stronger productivity growth in the UK. This is encouraging news as over the last five years the UK has experienced a productivity crisis, with the ONS estimating that productivity levels currently stand as much as 15% below where they would’ve been if the pre-financial crisis trend growth in productivity had continued.

On the basis of the YouGov/Cebr data, Cebr estimates that UK productivity growth will reach its fastest pace in two years, with annual growth of 0.8% projected for Q3 2013 (see Figure 3 below). A return to productivity growth is crucial for the UK’s long term economic health and points to a more sustainable recovery. However, if UK economic growth continues to come from enhanced productivity performance, job creation is likely to be only steady. Hence, the unemployment rate will decline only slowly – implying Bank of England interest rates will remain the same for some time to come.

Source: Office for National Statistics, Cebr analysis

Cebr Executive Chairman Professor Douglas McWilliams: “It’s clear from this indicator that the present recovery is now broader-based than the false dawn we saw in 2010. The YouGov/Cebr Consumer Confidence Index points to a further acceleration in growth in Q3 2013 and suggests the UK economy is on track for its strongest performance since 2010, as long as external global factors don’t blow up. Given this continued momentum, we would expect growth next year to be its strongest since 2007 – before the financial crisis crippled the real economy.

“The evidence in these data shows that productivity growth is picking up, which is good news for the long term health of the economy. If this continues, it suggests that higher output will be achieved from productivity gains rather than job creation, indicating the unemployment rate will fall back slowly. Importantly, this means that markets are wrong to doubt Governor Mark Carney’s forward guidance policy as it will take quite some time for the Bank of England’s seven per cent unemployment ‘signpost’ to be reached.”

Other key findings from YouGov/Cebr's HEAT data, September 2013:

- The YouGov house price indicator continues to show strong expectations for house price growth, standing at 145.4 in the three months to September, 48.1% up on a year before. (56% of homeowners expect the value of their property to increase over the coming 12 months.)

- In line with the uptick in both confidence and the housing market, consumers are starting to become less cautious on debt. Over the three months to September, 34.7% of consumers report expecting to reduce their mortgage debts over the coming year – down from 35.7% in August and the first drop in this share since May 2012.

- In addition, the proportion of those expecting to reduce their credit card debt fell to 49.7% in the three months to September, down from a previous reading of 52.0%.

Click here to learn more about YouGov's Household Economic Activity Tracker