Voters support George Osborne's plan to freeze benefits for the unemployed – but they tend to think that in-work tax credits should be exempt

Speaking at the Conservative Party Conference on Monday George Osborne said a future Tory government would freeze benefits for two years, excluding pensions, disability benefits and maternity pay, saving £3.2 billion overall to pay off the deficit and stopping benefits from rising faster than wages. The freeze would amount to a real-terms cut in welfare payments, affecting around 10 million households – roughly half of which are working – and would cost the average family affected £500.

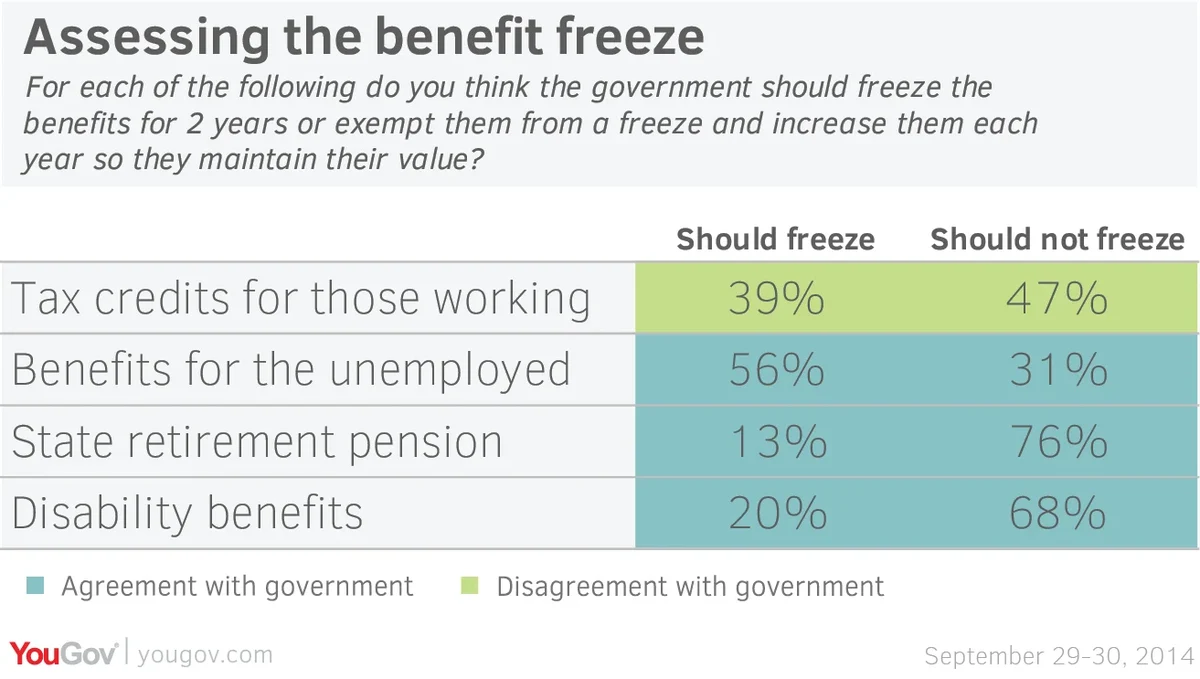

New YouGov research finds that three elements of George Osborne’s benefits freeze are popular, but one tends to be opposed.

The British public agree with the Chancellor that disability benefits should be exempt (68%) from a freeze, and should be increased each year to maintain their value against inflation; as should state pensions (76%). They also say that benefits for the unemployed should be frozen for two years, by 56-31%. On this only Labour voters tend to oppose, by 52-38%.

However the decision to freeze tax credits for those in work is controversial, and is opposed by 47-39%. Even a third (32%) of Conservatives and 41% of UKIP supporters say benefits for the employed should not be cut.

‘Google tax’

To raise money elsewhere, Mr Osborne also announced a crackdown on the so-called double Irish arrangement, whereby multinationals make profits in Britain but declare them in countries with lower taxes. The Chancellor’s policy has been dubbed the ‘Google tax’.

The vast majority of British people think this is a good idea (81%), however only 20% believe the Conservatives will succeed in significantly reducing such tax avoidance.

At Conference today, David Cameron sweetened Mr Osborne’s pill with an increase in the tax-free allowance from £10,500 to £12,500 by 2020. He also would raise the 40p income tax threshold to £50,000 and scrap the 55% tax rate on inherited pension funds.

Image: PA